Hadrius: SEC Compliance Automation for Financial Firms

In the ever-evolving landscape of financial regulations, compliance has become a paramount concern for investment managers. With the Securities and Exchange Commission (SEC) tightening regulations each year, financial firms are faced with the daunting task of ensuring ongoing compliance while grappling with the soaring costs associated with it. Enter Hadrius, an innovative start-up based in New York, founded in 2021, that aims to automate the entire SEC compliance process for financial firms using the power of artificial intelligence (AI). In this article, we will explore how Hadrius is revolutionizing the compliance landscape, the challenges it addresses, and why it stands out among existing solutions.

The Challenge of Ongoing SEC Compliance

Financial firms across the United States collectively spend over $2 billion annually on ongoing SEC compliance. As regulations become increasingly stringent, these costs continue to rise. Unfortunately, many firms rely on outdated software, third-party consultants, and manual processes to bridge the compliance gap. This leads to excessive expenses, with firms spending upwards of $10,000 per employee per year on regulatory compliance. Furthermore, the manual workload involved in compliance tasks leads to tedious and time-consuming processes that divert resources from core business activities.

The Hadrius Solution

Hadrius offers a comprehensive solution to automate the ongoing SEC compliance process for investment managers. By leveraging AI technologies, Hadrius streamlines compliance tasks, saving compliance teams hours of manual work each day. The platform scans various communication channels, including emails, Slack, and SMS, using GPT3 (a powerful AI model), to flag non-compliant language and expedite correspondence review. This feature significantly reduces the time and effort required for manual reviews and enhances efficiency within compliance teams.

Hadrius goes beyond communication review and extends its automation capabilities to marketing review and regular filings. The platform automates billing reviews, allocation reviews, and rollovers by seamlessly integrating with investment managers' existing compliance stack, such as client CRMs and trading systems. This integration ensures a holistic approach to compliance, enabling firms to centralize their compliance efforts and effectively manage tasks from a single intuitive dashboard.

Key Features and Benefits of Hadrius

Fully Automated Compliance Process

Hadrius automates a wide range of compliance tasks, eliminating the need for manual intervention and reducing human errors. The platform empowers compliance teams to focus on strategic initiatives while leaving routine tasks to the AI-powered autopilot.

Intelligent Flagging and Review

Through its advanced AI algorithms, Hadrius can accurately identify non-compliant language and flag it for review. This feature ensures that compliance teams can efficiently prioritize their efforts and address potential issues promptly.

Seamless Integration

Hadrius seamlessly integrates with investment managers' existing compliance stack, allowing for a smooth transition and minimal disruption to established workflows. By leveraging the data and systems already in place, the platform enhances compliance capabilities without introducing additional complexity.

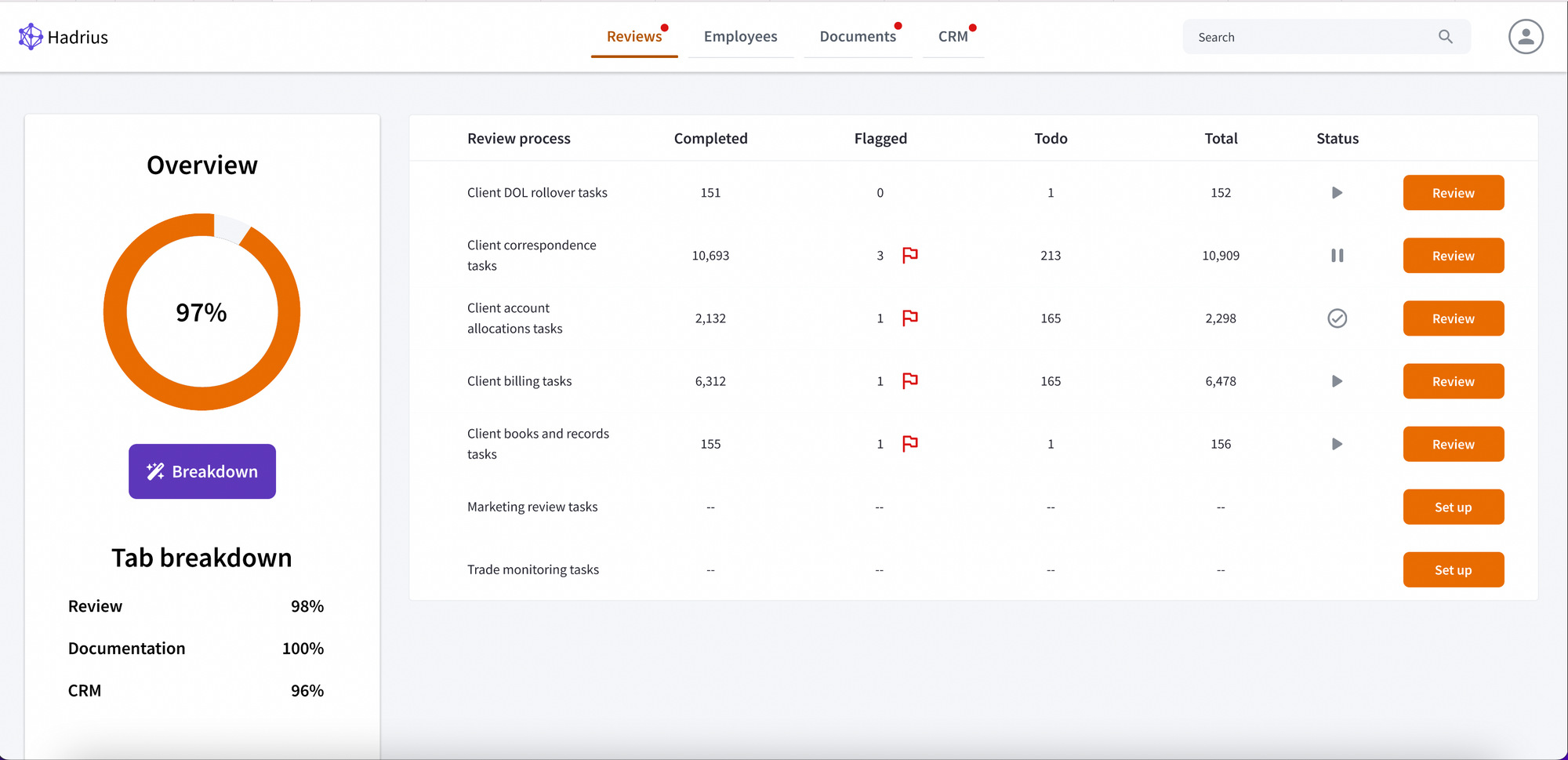

Intuitive Dashboard

The comprehensive dashboard provided by Hadrius serves as the control center for compliance activities. Compliance officers and their teams can easily manage automated tasks, review flagged items that require human input, and monitor compliance progress in real-time. This centralized approach offers a holistic view of compliance efforts, fostering efficiency and transparency.

The Founders and their Expertise

Hadrius was founded by a team of experienced professionals who have firsthand knowledge of the challenges faced by financial firms in achieving ongoing SEC compliance. Let's take a closer look at the founders:

Thomas Stewart (CEO)

Thomas Stewart is a seasoned entrepreneur and a two-time founder, with one successful exit under his belt. With a deep understanding of the complexities and nuances of compliance, Thomas recognized the need for a transformative solution in the SEC regulatory landscape. His entrepreneurial spirit and experience in navigating the intricacies of compliance have been instrumental in shaping Hadrius into a groundbreaking platform.

Allen Calderwood (CTO)

As the Chief Technology Officer of Hadrius, Allen Calderwood brings a wealth of technical expertise to the team. With a background in quantitative analysis and extensive experience in the technology industry, including his tenure at Google and Chime, Allen possesses a deep understanding of AI and machine learning. His technological acumen has been pivotal in the development and implementation of Hadrius's cutting-edge AI capabilities.

Som Mohapatra (Advisor)

Som Mohapatra, an esteemed advisor to Hadrius, brings a wealth of industry knowledge and experience to the table. With a background in hedge funds and a deep understanding of compliance challenges, Som provides valuable insights and guidance to ensure that Hadrius remains at the forefront of innovation in the compliance space.

Together, this founding team combines their diverse skill sets, entrepreneurial drive, and industry experience to propel Hadrius forward as a disruptive force in SEC compliance automation.

Company Launch and Benefits

Hadrius launched with the aim of revolutionizing SEC regulatory compliance by leveraging AI and automation. The benefits that Hadrius offers to financial firms are substantial:

Significant Cost Reduction

By automating labor-intensive compliance tasks, Hadrius enables financial firms to drastically reduce costs associated with ongoing SEC compliance. With thousands of hours saved annually and a reduction in the reliance on third-party consultants and outdated software, Hadrius offers a cost-effective solution that optimizes resource allocation.

Enhanced Efficiency and Accuracy

The AI-powered autopilot of Hadrius ensures a higher level of accuracy in compliance tasks, minimizing the risk of human errors. By flagging non-compliant language and streamlining review processes, the platform allows compliance teams to focus on strategic initiatives and critical compliance issues, ultimately improving efficiency and reducing compliance-related bottlenecks.

Real-time Monitoring and Reporting

Hadrius provides a centralized dashboard that offers real-time monitoring and reporting capabilities. Compliance officers and their teams can access comprehensive analytics, track progress, and generate detailed reports on compliance activities. This level of visibility and transparency enables proactive decision-making and facilitates seamless collaboration within compliance teams.

Scalable and Customizable Solution

Hadrius is designed to cater to the unique needs of investment managers, allowing for scalability and customization. The platform seamlessly integrates with existing compliance systems, ensuring a smooth transition and minimal disruption. Additionally, the AI algorithms powering Hadrius can be fine-tuned and customized to adapt to specific compliance requirements, providing tailored solutions for each financial firm.

The Vision for a Compliance-Driven Future

Hadrius envisions a world where compliance is an effortless state for financial firms, eliminating the constant worry and expensive vigilance required to maintain regulatory compliance. By automating tedious tasks and leveraging AI to streamline the compliance process, Hadrius aims to empower compliance teams to operate more efficiently and effectively. The ultimate goal is to create a compliance landscape where financial firms can allocate their resources towards strategic initiatives and focus on driving growth while having confidence in their regulatory compliance.

Securing Funding and Scaling Operations

In September 2023, Hadrius secured a $2 million seed funding round led by Y Combinator, along with Lynett Capital, Singularity Capital, and other notable investors such as Dorm Room Fund and Unpopular Ventures. This funding round is set to bolster Hadrius’s capabilities, enabling the startup to extend its compliance coverage across more communication channels, refine its AI-powered "ComplianceGPT" model, and scale its operations to serve a broader range of financial firms. The investment signifies growing confidence in Hadrius's potential to modernize and streamline SEC compliance in the financial sector.

Expanding Compliance Capabilities

Hadrius’s product development efforts are aimed at improving and expanding its AI-driven platform to provide deeper automation across critical compliance areas, including communication review, marketing review, archiving, and trade monitoring. By integrating these compliance functions into a single modern platform, Hadrius reduces the complexity that financial firms traditionally face when managing regulatory obligations. The new funding will also allow the startup to improve the efficiency and accuracy of their ComplianceGPT model, bringing even greater time savings and reliability to their clients.

Reaching Cash Flow Positive and Maintaining $200B+ in AUM

Hadrius recently achieved a significant milestone by becoming cash flow positive, demonstrating strong business fundamentals and market demand. This follows the impressive accomplishment of overseeing $200 billion in assets under management (AUM) for their clients’ compliance needs. This milestone further validates Hadrius's ability to offer a scalable and cost-effective compliance solution that not only saves time but also enhances the compliance processes for firms of all sizes.

Building a World-Class Engineering Team

Hadrius’s engineering team is composed of highly talented and experienced professionals who have previously worked at leading technology companies such as Google, Amazon, and fintech giants like Robinhood and Chime. With nearly a decade of experience in building full-stack consumer products and automating processes for top financial institutions, the team is well-equipped to push forward Hadrius’s vision of transforming compliance into an effortless, automated process. This expertise has been instrumental in the development and fine-tuning of Hadrius's AI technology, positioning it as a frontrunner in the financial compliance automation space.

Vision for the Future Beyond SEC Compliance

While Hadrius is currently focused on revolutionizing SEC compliance, its long-term vision extends far beyond. The founders envision a platform capable of automating compliance for a wide range of financial institutions, from asset managers to banks. By continuing to innovate and expand its offerings, Hadrius aims to make compliance not just more efficient but also more cost-effective for firms across the financial industry. The ultimate goal is to free up resources for financial firms, enabling them to focus more on client needs and business growth while having confidence in their regulatory compliance.

Conclusion

Hadrius is at the forefront of revolutionizing SEC compliance for financial firms, offering an innovative AI-powered solution that automates and streamlines complex regulatory processes. With its advanced platform, Hadrius simplifies tasks such as communication and marketing reviews, archiving, and trade monitoring, saving compliance teams significant time and reducing costs. Its seamless integration with existing systems, intuitive dashboard, and intelligent flagging capabilities make it a standout choice in a stagnant compliance industry.

The recent $2 million seed funding from Y Combinator and other prominent investors marks an exciting new chapter for Hadrius, enabling the company to expand its AI-powered ComplianceGPT model and extend its services to a broader range of firms. Reaching the milestone of becoming cash flow positive and maintaining over $200 billion in AUM underscores the company's effectiveness and market impact.

With a world-class engineering team and a clear vision for the future, Hadrius is poised not only to redefine SEC compliance but also to pave the way for automating compliance across the broader financial sector. By freeing firms from the costly and labor-intensive burden of regulatory compliance, Hadrius empowers them to focus on what truly matters: growth and client satisfaction.