Risk Mitigation in Crypto: The Immuna Startup

Are you a crypto investor, worried about the ever-evolving risks in the digital asset landscape? Do you fear the repercussions of unforeseen exploits, economic downturns, and vulnerabilities that could threaten your investments? If so, then you're not alone. In the volatile world of cryptocurrency, risk mitigation is paramount. Fortunately, a promising startup called Immuna has emerged to address these concerns. In this article, we'll delve deep into the world of Immuna, exploring its founders, its mission, and how it can help safeguard your crypto assets.

Who Are the Visionaries Behind Immuna?

Behind every successful startup, there's a team of dedicated individuals with a shared vision. Immuna is no exception. Founded in 2022, Immuna boasts a team of four exceptional professionals, each bringing their unique expertise to the table.

Gaurav Aggarwal: The Risk Management Pioneer

Gaurav Aggarwal, one of the co-founders of Immuna, is a true builder at heart. With a background in leading technical teams for tech giants like Google, LinkedIn, and Microsoft, Gaurav has a rich history of leveraging technology to solve complex problems. Before co-founding Immuna, he successfully exited an applied AI startup called Sleek. During his tenure at Sleek, Gaurav led product and engineering efforts, utilizing AI to accurately detect wait times at popular venues from multiple data sources. Sleek's groundbreaking technology even earned a spot on the Forbes AI 50 list, catapulting Gaurav to the status of a Forbes 30 under 30 honoree.

You may also like: Companies that use Python

Anuja Verma: The Champion of Financial Inclusion

Anuja Verma, the other co-founder of Immuna, is passionate about financial inclusion for all. She firmly believes that Web3 technology can be the instrument to achieve this goal. With a wealth of experience at Amazon, where she spent a decade solving deep technical problems across various domains, including Transaction and Risk Management, Alexa, and AWS, Anuja is well-equipped to tackle the challenges of the crypto space. She holds an MBA from the Haas School of Business at the University of California Berkeley, further enhancing her business acumen.

A Shared Vision: Building Immuna

In the words of the founders, "Honestly, we built Immuna to keep our investments safe! But, seriously, moving into the Web3 space, you get bombarded with everything you need to check out! Then you hear all these stories of crypto veterans losing everything just because they made one click! We have enough stress in our lives as it is—staying vigilant every time we do something in Web3 is a bit much!"

What Is Immuna, and How Does It Work?

Now that we know who's behind Immuna, let's dive into the core of their innovation. Immuna is a risk management platform tailored specifically for digital asset investors. Its mission is clear: to monitor and proactively defend investors' digital asset investments from unexpected exploits and undesirable economic situations.

You may also be interested in: Coder vs Programmer: Main Differences

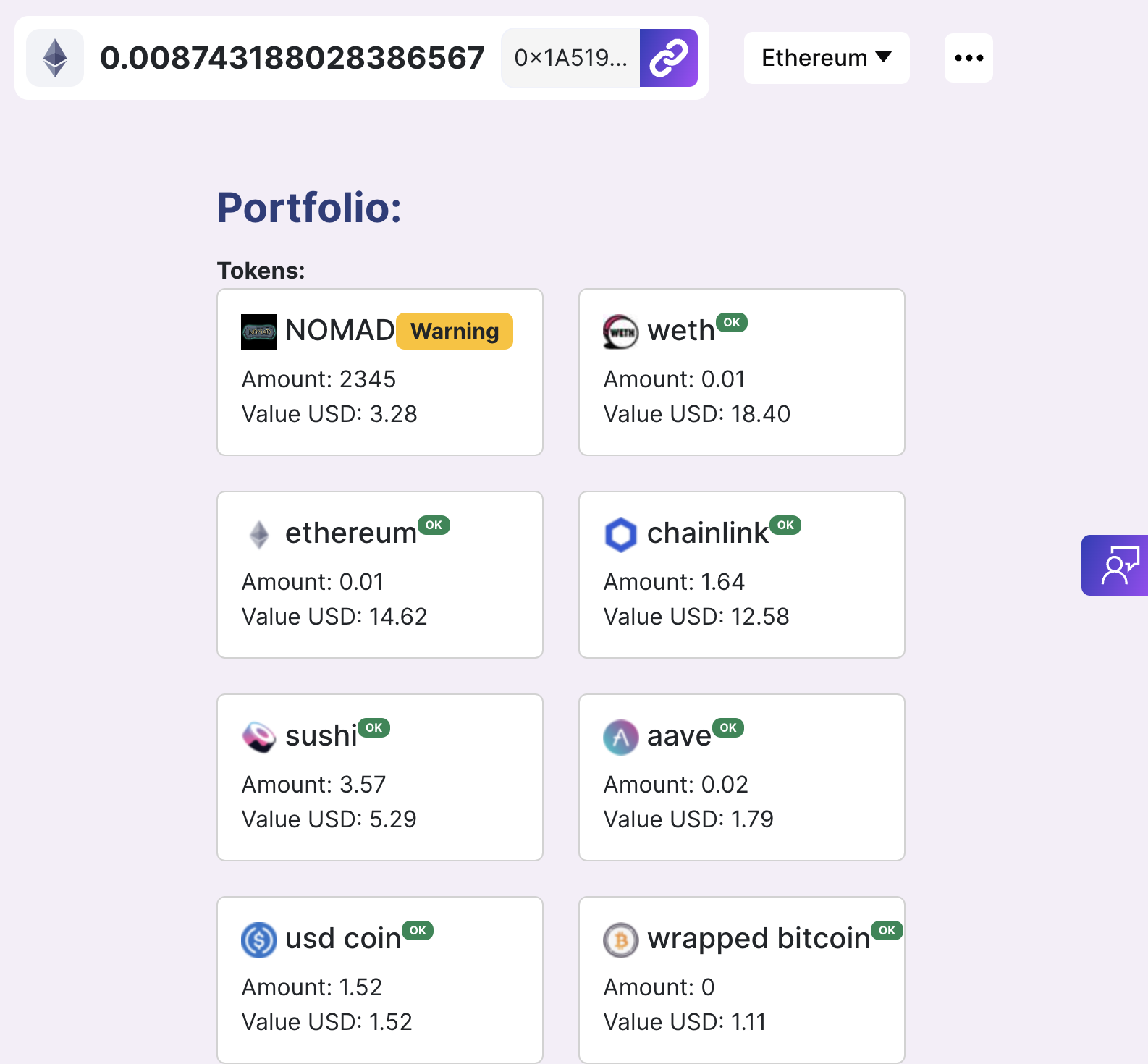

Monitoring Your Assets: Simplified

Immuna offers a straightforward solution for safeguarding your digital assets. All you need to do is provide them with your Ethereum addresses and your preferred means of notification, and they handle the rest. For institutions, Immuna streamlines the onboarding process by integrating with top custody providers. Once you're onboarded, Immuna identifies your assets and the protocols in which you're invested. It then initiates real-time monitoring across on-chain, mempool, and social data to detect potential exploits. As an added bonus, users have the option to create custom monitoring rules based on the events generated by the platform.

Defending Your Assets: Without Surrendering Your Private Keys

One of the most innovative aspects of Immuna is its ability to take defensive actions on your behalf, all without requiring access to your private keys. Depending on your investment types, you can grant specific rights to Immuna's smart contract. This contract can then take predefined actions on your behalf in response to undesirable events related to your investments. In essence, Immuna acts as your automated guardian, ready to respond when needed to protect your assets.

Who Is Immuna For?

You might be wondering if Immuna is right for you. Well, if you fall into any of the following categories, it could be the solution you've been searching for:

Crypto Hedge Funds

If you manage a crypto hedge fund, you understand the importance of risk mitigation in this volatile market. Immuna offers a lifeline to protect your fund's investments from unforeseen threats.

Liquid Token Funds (VC and Hedge Fund)

Whether you're a venture capital or hedge fund focused on liquid tokens, Immuna's proactive defense mechanisms can help secure your investments and minimize potential losses.

Family Offices

Family offices entrusted with managing substantial wealth in digital assets can rely on Immuna to add an extra layer of security to their portfolio management.

High Net Worth Individuals

Individuals with significant investments in digital assets, including activities like lending, staking, and trading, can benefit from Immuna's automated risk management.

Real-World Examples: How Immuna Could Have Saved Millions

To illustrate the real-world impact of Immuna, let's take a look at a couple of case studies where its risk mitigation capabilities could have saved investors substantial sums.

Case Study 1: The $120M BadgerDAO Hack

In this case, a frontend attack compromised user wallets with unauthorized approvals, resulting in a staggering loss of $120 million. Immuna's automated monitoring and defense mechanism would have detected anomalous events and proactively front-run the wallet-draining transaction, potentially preventing this massive loss.

Case Study 2: The 90% Rari Capital Pool Drop

The ICHI token experienced a harrowing 90% drop in value due to the accumulation of bad debt in the ICHI Fuse Pool within Rari Capital. This drop occurred because of cascading liquidations, causing massive losses. Immuna could have detected the lack of liquidity and the imbalance in the pool before it imploded. Its automated defense mechanism would have swiftly exited ICHI positions, converting them to the stable USDC, preserving substantial wealth for investors.

You may also like: Cascading AI

Conclusion: Safeguarding Your Crypto Future with Immuna

In the unpredictable world of cryptocurrency, where risks abound, Immuna stands as a beacon of hope for investors. Founded by visionary individuals with a track record of technological excellence, Immuna offers a comprehensive solution for risk mitigation. It monitors your assets, detects potential threats, and takes proactive defensive actions—all without requiring access to your private keys.

So, if you're a crypto hedge fund, liquid token fund, family office, or high-net-worth individual seeking to protect your digital assets in the DeFi landscape, Immuna is here to offer you peace of mind. Say goodbye to the constant stress of monitoring your investments manually, and embrace the future of risk management with Immuna. Your crypto future deserves nothing less.

In the dynamic world of cryptocurrency, Immuna is your steadfast partner, committed to keeping your investments safe and secure, even in the face of the most unexpected challenges. Don't wait—empower your crypto journey with Immuna today!

Contact us at Hiretop, and empower your business with a robust team geared for swift, efficient, and groundbreaking development.