Unlocking the Future of Insurance Risk: CatX - A Digital Marketplace Revolution

In a world where financial markets are constantly evolving, the insurance industry has been in dire need of innovation and efficiency. Enter CatX, the digital marketplace for insurance risk. Founded in 2023 by two visionaries, Benedict Altier and Lucas Schneider, CatX aims to revolutionize the way insurance companies manage and transfer risk while opening up exciting new opportunities for institutional investors. In this article, we'll explore the intriguing story behind CatX, the challenges it seeks to overcome, and the transformative solutions it offers.

Who Are the Minds Behind CatX?

Benedict Altier: A Multifaceted Expert

Benedict Altier, one of the co-founders of CatX, brings a wealth of experience to the table. With a background in advising leading insurers and asset managers across insurance, reinsurance, and risk modeling, Altier's expertise is invaluable. Moreover, Altier is not just a financial expert; he's also a seasoned front-end developer, boasting a decade of experience in designing and building web applications. His academic credentials are equally impressive, with a 1st class degree in Chinese Studies from the University of Oxford. During his time as a visiting student at Peking University, Altier even advised prominent Chinese technology companies, including a spin-out from tech giant Baidu.

Lucas Schneider: Bridging Finance and Insurance

Lucas Schneider, the other co-founder of CatX, is a true financial luminary. His career kicked off in the world of Credit Securitization at Barclays in London, where he structured and executed multiple transactions exceeding a staggering $10 billion. Schneider's academic journey is equally noteworthy, with a background in Machine Learning for Gene Editing, which led him to pursue a PhD at the University of Oxford before taking a different path. Prior to founding CatX, he led a research team at a web3 hedge fund, focusing on infrastructure and decentralized finance investments. Schneider's journey from finance to insurtech showcases the interdisciplinary spirit that drives innovation at CatX.

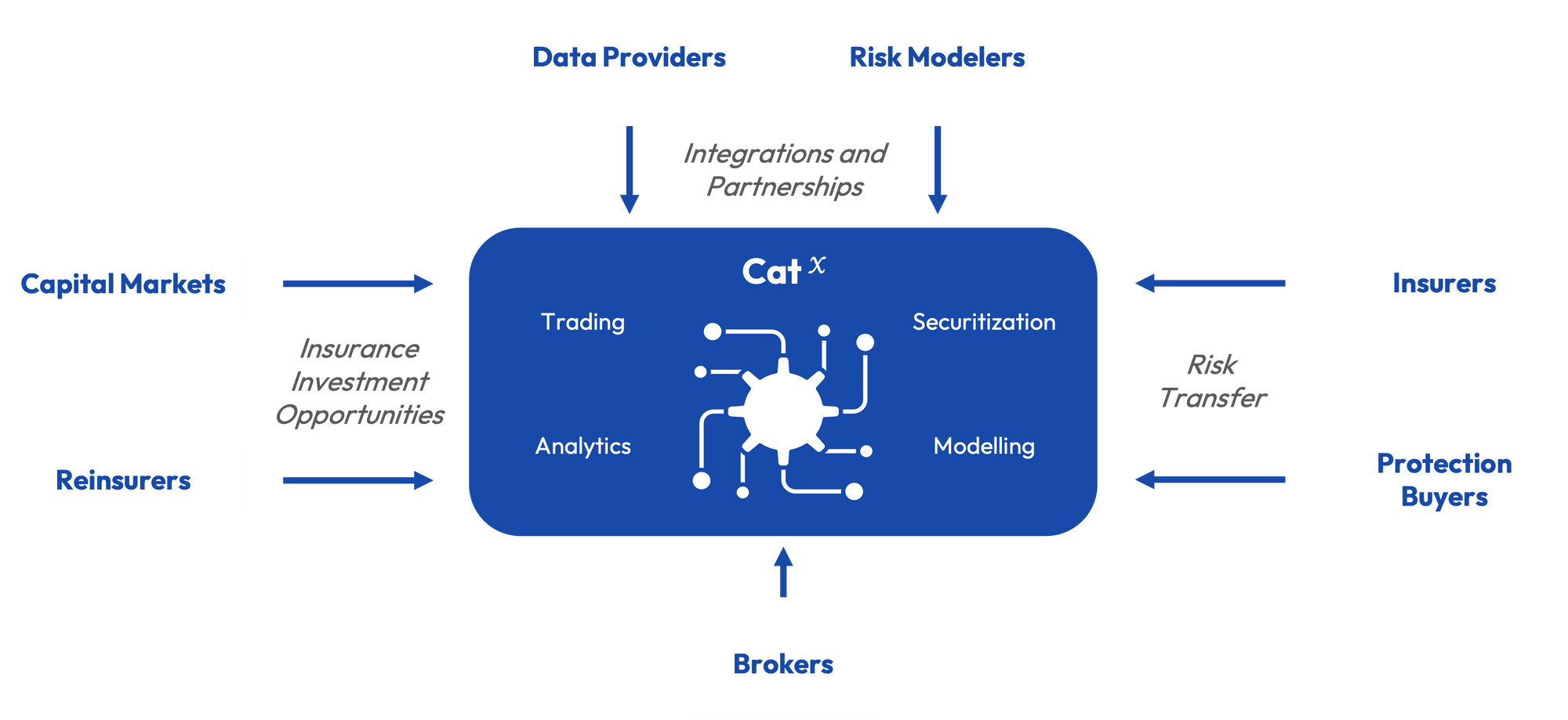

CatX: The Digital Marketplace for Insurance Risk

What is CatX, and Why Was It Founded?

CatX is more than just a startup; it's a game-changer in the insurance and risk management industry. Founded in 2023, CatX was born out of a shared vision to revolutionize risk transfer for insurers. With a team of just two individuals, Altier and Schneider, CatX set out on a mission to bridge the gap between insurance carriers and institutional investors, creating a digital marketplace for insurance risk that is efficient, accessible, and transparent.

The Problems CatX Aims to Solve

Before delving into CatX's innovative solutions, it's crucial to understand the pressing issues it addresses within the insurance industry:

Rising Hedging and Funding Costs

Over the past six years, the cost of hedging and funding for insurers has been on a relentless upward trajectory. In the US property market alone, rates have surged by a staggering 265%. This rise in costs has put immense pressure on insurance companies to find more efficient ways to manage their risk and capital.

Inefficient Risk Transfer Markets

Despite advancements in technology, the insurance industry has struggled to make risk transfer more efficient. The average cost ratios for risk transfer remain around 40%, a stubborn statistic that CatX aims to change.

Slow and Expensive Product Structuring

Creating and structuring new insurance-linked products is a complex, time-consuming, and costly process. It often involves multiple parties, leading to delays and high expenses for insurers.

Limited Secondary Market Liquidity

Insurance-linked securities, a vital component of the industry, suffer from limited secondary market liquidity due to their complex economics and the scarcity of reliable risk models. This lack of liquidity hampers the industry's ability to adapt and respond quickly to changing market conditions.

Inadequate Analytics and Data-Driven Insights

The insurance industry has traditionally lagged behind in terms of data analytics and insights. This lack of robust data-driven decision-making has hindered the understanding of emerging and novel areas of risk.

The CatX Solution

CatX doesn't just identify problems; it offers innovative solutions to these challenges that have long plagued the insurance industry. Let's explore how CatX is reshaping the landscape:

Simplifying the Market

CatX simplifies the complex world of insurance risk transfer by providing access to the world's most advanced modeling technologies directly within its platform. This democratization of technology allows insurers and investors to make more informed decisions, reducing the complexity and opaqueness of the risk transfer process.

Streamlining Origination

One of the key pain points in the insurance industry is the slow and expensive process of creating and structuring new insurance-linked products. CatX streamlines this process, making it faster, more cost-effective, and less burdensome for insurers. This means quicker access to capital and reduced overhead costs.

Electronic Secondary Trading Venue

To address the issue of limited secondary market liquidity for insurance-linked securities, CatX introduces an electronic secondary trading venue. This marketplace enhances liquidity and facilitates the buying and selling of insurance risk contracts, providing greater flexibility for insurers and investors alike.

Advanced Analytics and Insights

In the age of data, CatX recognizes the importance of analytics and data-driven insights. The platform offers sophisticated analytics tools that empower users to gain a deeper understanding of risks, both conventional and emerging. This analytical prowess enables more informed decision-making and a proactive approach to risk management.

How CatX Benefits Key Stakeholders

Insurers: Access to Capital at Better Rates

For insurance companies, CatX represents a game-changing opportunity. By providing direct access to capital markets, insurers can secure funding at more favorable rates. This means lower capital costs and increased profitability, which is particularly critical in an industry characterized by tight margins.

Investors: Unlocking New Opportunities

Institutional investors, such as asset managers, can tap into a previously untapped asset class through CatX. By investing in insurance risk, investors can diversify their portfolios and access an uncorrelated asset class. This diversification can be a boon in times of market volatility, providing stability and potentially higher returns.

Protection Buyers: Efficient Risk Transfer

Protection buyers, typically entities looking to offload risk, benefit from CatX's efficient structures for risk transfer. This streamlining reduces the protection gap for novel and emerging risks, ensuring that businesses and organizations can effectively manage and mitigate their exposures.

The Future of Insurance Risk: CatX's Vision

As CatX gains momentum and reshapes the landscape of insurance risk management, it's evident that this startup has the potential to transform an entire industry. With its innovative approach, CatX addresses longstanding challenges, offering benefits to insurers, investors, and protection buyers alike. In a world where adaptability and efficiency are paramount, CatX stands as a beacon of hope for the insurance industry, unlocking new possibilities and ushering in a brighter future.

In conclusion, CatX is not just a digital marketplace; it's a catalyst for change. With a dedicated team, a visionary mission, and innovative solutions, CatX is poised to redefine the insurance industry and lead it into a new era of efficiency, transparency, and profitability. The journey has just begun, but the destination promises to be nothing short of revolutionary. Watch this space as CatX continues to unlock the future of insurance risk.