Introducing coil: Revolutionizing Subscription Payments with Pay-by-Bank

Meet the Founders

coil, a San Francisco-based startup, is making waves in the payment industry with its innovative solution for subscription businesses. Founded in 2022 by Eleazar Vega-Gonzalez and Ryan Hall, two industry veterans, coil is on a mission to disrupt incumbents and provide a seamless payment experience for merchants and customers alike.

Eleazar Vega-Gonzalez is a serial entrepreneur with a passion for combining efficient technology and delightful user experiences. His previous venture, Reduced Energy Microsystems, focused on developing low-power processors for edge AI. With funding from Y Combinator, Draper Associates, and the National Science Foundation, Eleazar demonstrated his ability to create successful startups.

Ryan Hall, on the other hand, brings a wealth of engineering and software development experience to the table. Having worked on secure and reliable financial systems at Modern Treasury, Zenefits, and Harbor (acquired by BitGo), Ryan is well-versed in building robust systems that can handle large-scale transactions.

Both founders have strong educational backgrounds, with degrees in Electrical & Computer Engineering and Computer Science and Information Systems from Carnegie Mellon University. Their combined expertise and passion for innovation make them an exceptional team to tackle the challenges in the payment industry.

The Launch of coil

With a clear vision in mind, Eleazar and Ryan launched coil in 2022. The company's primary focus is to help businesses seamlessly accept bank payments, thereby reducing processing fees and churn. By leveraging the power of bank transfers, coil aims to revolutionize the way subscription payments are processed.

The Problems with Credit Card Payments

One of the major pain points for subscription businesses is churn caused by credit card declines. Recurring credit card charges are declined 15% of the time, accounting for a significant portion of churn—48% to be precise. This makes credit card declines the largest source of churn for most subscription-based companies.

Furthermore, credit card processing fees have become a burden for American businesses, costing them over $138 billion last year alone. With Visa and Mastercard dominating the market and controlling more than 70% of it, there is little incentive for these card networks to reduce the fees. This poses a significant challenge, particularly for businesses selling high-ticket items or operating on slim profit margins.

The Innovative Solution by coil

coil recognizes these challenges and aims to address them head-on. The company's solution lies in eliminating credit cards from the equation and replacing them with bank payments. By doing so, coil can cut processing fees by up to 80% and eliminate the churn caused by credit card declines.

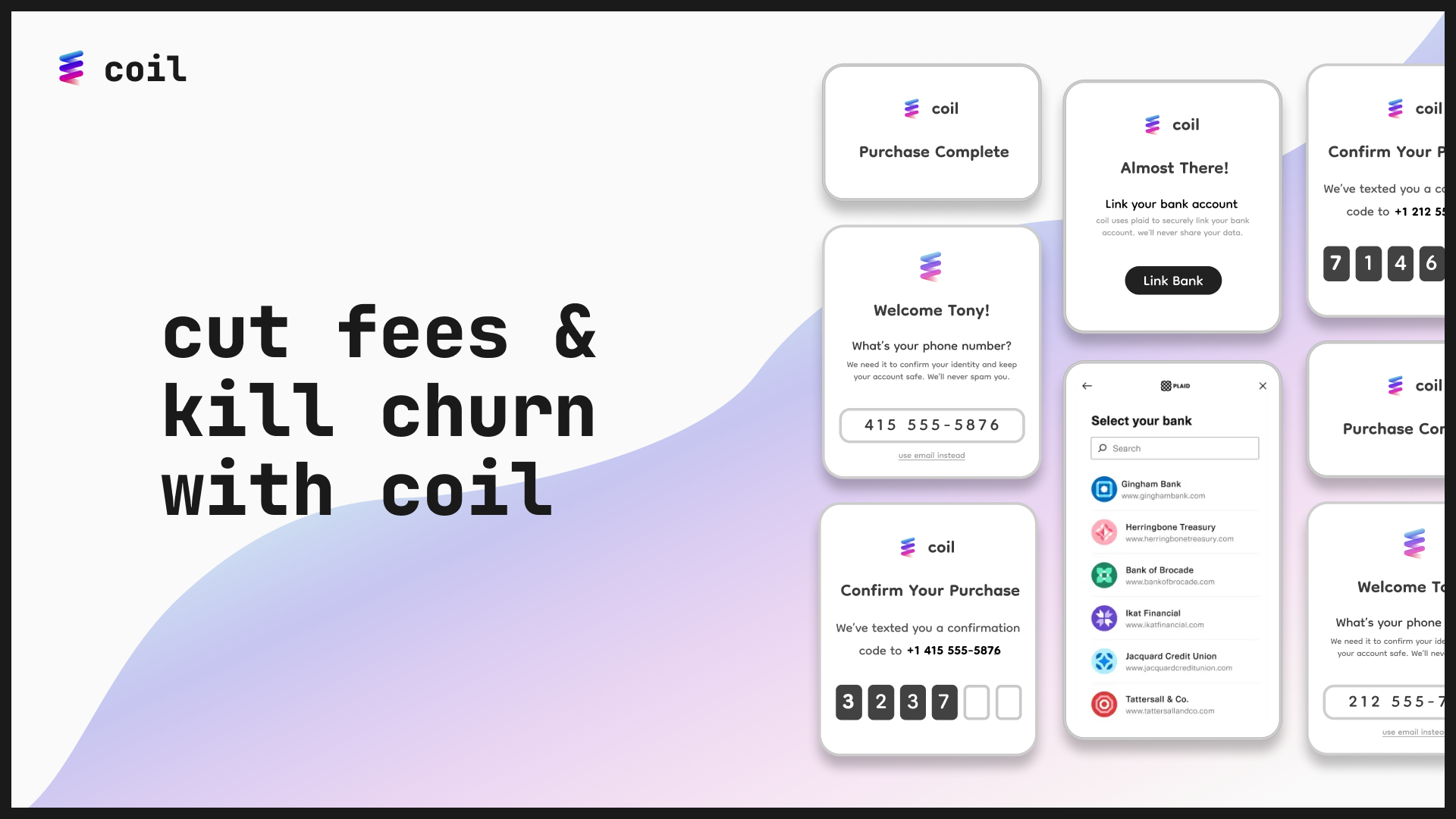

To achieve this, coil has developed a seamless payment experience for customers. Their first product is the "Pay with coil" button, which can be integrated into existing checkout flows for both one-off and subscription payments. Customers using coil for the first time can securely link their bank accounts through Plaid, a trusted banking API platform. Subsequent payments can be authenticated in seconds through SMS or email verification codes, ensuring a frictionless experience for the customers.

The Seamless Pay-by-Bank Experience

The coil payment experience offers several advantages over traditional ACH (Automated Clearing House) transfers. By leveraging Plaid's secure bank linking capabilities, coil removes the need for customers to manually enter their account and routing numbers, which often leads to errors and friction in the payment process.

With coil, customers can enjoy a seamless pay-by-bank experience that simplifies the payment process and enhances convenience. By integrating the "Pay with coil" button into their checkout flows, businesses can provide their customers with an alternative payment method that reduces the likelihood of credit card declines and eliminates the associated churn.

One of the key advantages of coil's pay-by-bank approach is the elimination of account and routing number entry. Instead of manually inputting sensitive banking information, customers securely link their bank accounts through Plaid. This integration streamlines the process, reducing errors and saving time for both customers and businesses.

Once the initial bank account linkage is established, coil offers a swift and straightforward verification process. Customers can verify their identity through SMS or email verification codes, ensuring secure and authenticated payments in a matter of seconds. This efficient method eliminates the need for complex microdeposits or other cumbersome verification procedures commonly associated with traditional ACH transfers.

The ease and speed of coil's pay-by-bank experience not only enhance customer satisfaction but also benefit businesses. By providing a hassle-free payment method, coil reduces friction in the checkout process, resulting in higher conversion rates and increased customer retention.

The Future of coil

coil's vision extends beyond providing a seamless pay-by-bank experience for subscription payments. The company aims to become the default payment method in a post-credit card world. While their initial product focuses on integrating with existing checkout flows, coil has plans to expand its capabilities and partnerships in the future.

As coil continues to grow, they will work on developing additional scenarios and integrations that cater to a wide range of industries and payment use cases. By collaborating with various platforms and payment processors, coil aims to make bank transfers the preferred method for businesses and customers alike.

In addition, coil recognizes the importance of data security and compliance in the payment industry. The company is committed to maintaining the highest standards of security and privacy to ensure that customer information is protected. By adhering to industry best practices and implementing robust security measures, coil builds trust and confidence among businesses and their customers.

coil is revolutionizing the subscription payment landscape with its innovative pay-by-bank solution. By enabling businesses to accept bank payments seamlessly, coil reduces processing fees, eliminates churn from credit card declines, and enhances the overall payment experience for customers. With a dedicated team of founders and a vision for the future, coil is poised to transform the way businesses handle subscription payments and pave the way for a post-credit card world.

Conclusion

coil, founded in 2022 by Eleazar Vega-Gonzalez and Ryan Hall, is an exciting startup based in San Francisco that is poised to revolutionize the subscription payment industry. With their innovative pay-by-bank solution, coil addresses the challenges faced by businesses, such as high credit card processing fees and churn caused by credit card declines.

By seamlessly integrating their "Pay with coil" button into existing checkout flows, coil provides customers with a convenient and secure alternative to credit cards. Through secure bank linking via Plaid and streamlined authentication processes, coil ensures a frictionless payment experience for both customers and businesses.

The impact of coil's solution goes beyond reducing processing fees and eliminating churn. By championing bank payments, coil envisions a post-credit card world where businesses can leverage the advantages of efficient and cost-effective payment methods. With their commitment to data security and compliance, coil instills trust and confidence among businesses and customers alike.

As coil continues to expand and forge partnerships within the industry, their vision of becoming the default payment method becomes closer to reality. By continuously refining their product and exploring new integrations, coil aims to cater to diverse industries and payment use cases, offering businesses a comprehensive solution for subscription payments.

With the impressive track records of the founders and their passion for innovation, coil is well-positioned to disrupt the incumbents and carve a prominent place in the payment industry. By combining efficient technology and delightful user experiences, coil is transforming the way businesses process subscription payments and paving the way for a future where bank payments become the norm.

In summary, coil is an ambitious startup that is revolutionizing subscription payments through their seamless pay-by-bank solution. By addressing the challenges of credit card processing fees and churn, coil empowers businesses to enhance their revenue streams and improve customer retention. As coil continues to innovate and grow, they are set to shape the future of payment processing, leading the way to a more efficient, cost-effective, and customer-centric payment ecosystem.