Introducing Drip - Revolutionizing Payment Solutions in Brazil

Are you tired of high credit card APRs and uninspiring rewards? Do you wish for a seamless, instant payment option while shopping? Look no further than Drip, the innovative startup that's changing the game in Brazil's payment industry. In this article, we'll dive deep into Drip, exploring its founding story, mission, and how it plans to revolutionize the way Brazilians shop and pay.

The Genesis of Drip - Meet the Founders

Who Are the Visionaries Behind Drip?

Before we delve into the intricacies of Drip, let's meet the brains behind this groundbreaking startup. Drip was founded in 2021 by a dynamic trio:

Patrick McDougall

Role: Co-founder and CEO

Work Experience: Patrick boasts a remarkable background, having previously worked at Nubank, a leading fintech company in Brazil. At Nubank, he led projects related to Pix, e-commerce, and open banking, among others. Prior to his tenure at Nubank, Patrick was involved in fintech (Guiabolso), strategy consulting (Bain), and Private Equity (NASDAQ: VINP).

Education: Patrick holds an INSEAD MBA and is a Chartered Financial Analyst (CFA).

Passion: He's not just a financial whiz; Patrick is also a running enthusiast living in São Paulo, Brazil.

Paulo Albuquerque

Role: Co-founder and Engineering Team Leader

Background: Paulo brings his technical expertise to Drip, leading the Engineering team. With years of experience in engineering management, he has been at the forefront of several teams in the fintech industry. Paulo holds a degree in Computer Science and an MBA in project management from Fucapi.

Bianca (Additional Founder)

While Bianca isn't mentioned extensively in the provided information, her contribution is undoubtedly invaluable to the team.

These three visionaries embarked on the Drip journey after their experiences at Nubank, believing that a solution built on Pix, Brazil's new instant payment scheme, could resolve many of the problems associated with traditional credit cards.

Unraveling Drip - Shop and Pay in Installments, Anywhere

What Is Drip, and What Does It Offer?

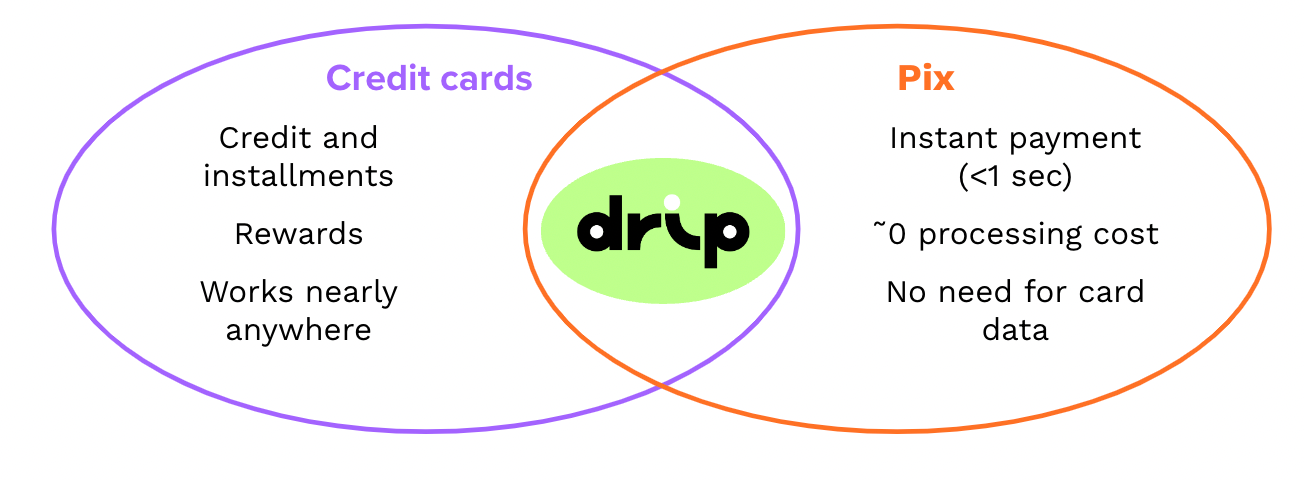

Drip is not your typical payment solution. It's a game-changer that combines the best features of Pix and a credit card, offering customers the ability to pay with credit while enjoying the speed and widespread acceptance of Pix. Here's what makes Drip stand out:

Cashback Rewards: Drip doesn't just facilitate payments; it also rewards its users. Customers can earn a generous 2%+ cashback on their transactions.

Seamless Shopping: Through the Drip app, customers can easily onboard, shop at nearly any store, and manage their payments, all from the convenience of their smartphones.

Leveraging Pix's Network: Drip leverages Pix's existing network, which covers a staggering 85%+ of e-commerce transactions in Brazil. This means you can use Drip to shop at your favorite online stores with ease.

Addressing Brazil's Payment Problems

What's Wrong with the Current Payment System in Brazil?

Brazil's payment landscape presents some unique challenges:

High Credit Card APRs

The average annual percentage rate (APR) on credit cards in Brazil can be exorbitant, often exceeding 400%.

Lackluster Credit Card Rewards

Many credit cards in Brazil offer uninspiring rewards, typically ranging from 0% to 1%.

Absence of Easy Payment Options

Unlike popular global alternatives like PayPal and Apple Pay, Brazil lacks a prevailing easy payment button that simplifies online transactions.

Merchant Woes

Merchants in Brazil face their own set of challenges, including hefty fees of up to 10-20% when receiving funds from a sale.

Drip's Solution - A Game-Changer for Payments

How Does Drip Solve These Problems?

Drip is here to disrupt the status quo by offering a comprehensive solution:

Bridging the Gap with Pix and Credit

Drip bridges the gap between Pix and credit cards, enabling customers to make payments using credit while enjoying the low cost, speed, and widespread acceptance of Pix. This means you can shop now and pay later without the hefty APRs.

Generous Cashback Rewards

Say goodbye to meager rewards. Drip users can earn 2%+ cashback on their transactions, ensuring that every purchase comes with a bonus.

Speed and Convenience

With Drip, you can download the app, choose your favorite store, browse and shop as you please, and then select Drip as your payment method through Pix. It's as easy as that.

Drip's Vision - Transforming the Future of Payments

What Lies Ahead for Drip?

Drip's mission goes beyond offering a convenient payment solution. The founders envision a future where Brazilians have access to a payment method that's fair, rewarding, and seamless. They are driven by the desire to:

Empower Shoppers: Drip empowers consumers by providing them with a flexible and rewarding payment option that suits their needs.

Support Merchants: By reducing the fees merchants pay for receiving funds, Drip aims to support businesses and contribute to a thriving e-commerce ecosystem in Brazil.

Enhance Financial Well-being: With lower APRs and cashback rewards, Drip intends to improve the financial well-being of its users.

Expand Access: Drip aims to reach a broader audience, ensuring that its solution is accessible to all Brazilians.

Drip's Impact - Changing the Way Brazilians Shop and Pay

How Will Drip Change the Payment Landscape in Brazil?

Drip is poised to make a significant impact on the payment landscape in Brazil:

Democratizing Payments

Drip's approach makes credit-based shopping more accessible to a wider audience, leveling the playing field for consumers.

Boosting E-commerce

By simplifying online payments and reducing merchant fees, Drip can contribute to the growth of e-commerce in Brazil.

Setting New Standards

Drip's innovative model challenges existing payment systems, encouraging competition and innovation in the industry.

Join the Drip Revolution

How Can You Be Part of the Drip Experience?

Are you ready to embrace a new era of payments in Brazil? Join the Drip revolution by downloading their app, exploring the seamless shopping experience, and enjoying the benefits of credit payments without the usual drawbacks. With Drip, you can shop and pay in installments anywhere, making your financial life easier and more rewarding.

In conclusion, Drip is more than just a startup; it's a visionary force that's poised to reshape Brazil's payment landscape. With its unique blend of Pix and credit, generous cashback rewards, and a mission to empower consumers and businesses alike, Drip is a name to watch in the world of fintech. So, keep an eye out for Drip as it continues to make waves in São Paulo, Brazil, and beyond.