Revolutionizing Derivatives Trading with EthosX: A Blockchain-Based Solution

In a world where the global derivatives ecosystem is plagued with inefficiencies and too many intermediaries, EthosX emerges as a beacon of hope. Founded in 2022 by two seasoned quantitative finance professionals, Deepanshu and Smit Patoliya, EthosX aims to transform the way derivatives are traded and managed. In this article, we'll delve into the world of EthosX, exploring its mission, founders, and how it plans to revolutionize the derivatives market.

Who Are the Visionaries Behind EthosX?

Deepanshu: The Quantitative Finance Expert

Deepanshu, the Co-founder and CEO of EthosX, boasts over 8 years of experience in quantitative finance. His journey began with an engineering degree from IIT Kharagpur, followed by an MBA from IIM Calcutta. Before founding EthosX, he served as the Vice President of Quantitative Research in the Global Derivatives Clearing business at JP Morgan Chase. Deepanshu's passion lies in leveraging blockchain technology to solve real-world problems, particularly those pertaining to financial markets.

Smit Patoliya: The Quantitative Finance Enthusiast

Smit Patoliya, with a B.Tech. in Chemical Engineering from IIT Madras, shares Deepanshu's passion for quantitative finance. Over the course of his career, Smit has focused on financial derivatives, making him a valuable asset to EthosX. His goal is to build comprehensive derivatives solutions on the blockchain, aiming to streamline and simplify the derivatives trading process.

Together: Uniting Expertise for Change

Together, Deepanshu and Smit have amassed nearly 15 years of experience in quantitative finance. They've witnessed firsthand the challenges and shortcomings of the derivatives ecosystem. Deepanshu's tenure as Vice President at JP Morgan Chase and Smit's experience at a quantitative hedge fund trading options have given them unique insights into the issues that persist within the derivatives market. They believe that blockchain technology holds the potential to eliminate many of these long-standing problems.

You may also like: Web Developer Salaries in California

The Birth of EthosX: A Decentralized Finance Platform

What Is EthosX?

EthosX is a groundbreaking decentralized finance platform focused on creating end-to-end financial derivatives on blockchains. Unlike traditional derivatives trading, EthosX eliminates the need for centralized exchanges, clearinghouses, depositories, clearing banks, and CSD participants.

A New Beginning: Cryptocurrency Options

EthosX's journey begins with cryptocurrency options. Their primary objective is to provide users with the ability to buy bitcoin hedging tokens directly from their platform. This innovative approach bypasses the involvement of exchanges or counterparties, enabling users to profit when the bitcoin price falls, akin to a put option. These tokens exist on-chain and can be held in wallets, sold, or transferred at any time.

Institutional Transformation: Redefining Derivatives Infrastructure

At an institutional level, EthosX offers an options infrastructure that allows two hedge funds to trade high-value on-chain options directly, without the need for banks or brokers. This approach mitigates counterparty risk and settlement risk, creating a more secure and efficient trading environment.

Beyond Trading: Empowering Crypto Companies

EthosX also extends its derivatives infrastructure to other crypto companies. These companies can integrate EthosX's products into their offerings, providing additional value to their customers. For example, DeFi lending protocols can leverage EthosX's solutions to offer liquidation protection to their borrowers.

The Problem: Why Does the Derivatives Ecosystem Need EthosX?

The Global Derivatives Ecosystem: A Broken Paradigm

The global derivatives ecosystem is in a state of disarray. Traditional derivatives trading involves numerous gatekeepers and intermediaries, leading to inefficiencies and frequent breakdowns. With a staggering USD 600 trillion in notional value at stake, one would expect a more robust system. Unfortunately, this is far from the reality.

The Crypto Conundrum: Centralization Creeping In

While crypto was once seen as a solution to these issues, it too is succumbing to centralization with dire consequences. Recent events have highlighted the risks associated with centralized entities, as exchanges and banks have disappeared with users' funds. This has eroded trust in centralized entities, particularly for complex products like derivatives.

You may also be interested in: Roblox devs for hire

The EthosX Solution: Bringing Derivatives to the Blockchain

A Paradigm Shift: Blockchain-Powered Derivatives

EthosX's solution lies in bringing the entire derivative trading lifecycle onto blockchains, covering trading, clearing, and settlement processes. Institutions can now engage in on-chain trading using smart contracts created by EthosX, completely bypassing banks, brokers, or exchanges. These on-chain trades carry zero counterparty risk, as the net payoffs are encoded in the smart contract. Additionally, settlement is automatic, facilitated by on-chain oracles, thereby eliminating settlement risk.

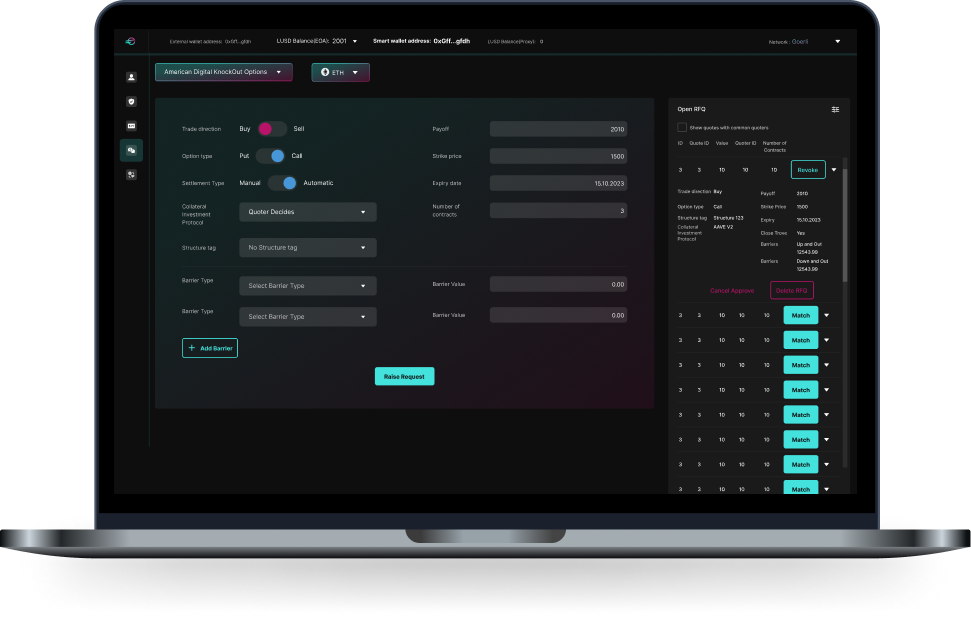

Liquidity Boost: The Request-For-Quote System

To further enhance liquidity, EthosX is implementing a Request-For-Quote (RFQ) system. This system will invite more participants to the market, creating a more vibrant and liquid trading environment. Liquidity is vital for the success of any derivatives market, and EthosX is committed to ensuring its platform thrives in this regard.

Evolution on the Horizon: Traditional Finance Integration

While the current focus is on cryptocurrency derivatives due to regulatory and technical considerations, EthosX has its sights set on traditional finance derivatives. The vision is to extend their blockchain-powered solution to the broader financial industry, revolutionizing derivatives trading on a global scale.

Exploring EthosX's Perpetual Options: A Game-Changer in Derivatives Trading

Are you ready to embark on a journey into the future of derivatives trading? Look no further than EthosX. This innovative platform is not merely a concept; it's a tangible reality reshaping the way we trade derivatives. At the heart of EthosX's transformative approach lies its Perpetual Options, a key component of the platform that has already made its debut on their website's testnet.

Unveiling Perpetual Options

Perpetual options are the crown jewel of EthosX's offerings. They represent a novel and revolutionary approach to derivatives trading. What sets them apart is their perpetual nature – unlike traditional options with fixed expiration dates, these options have no time constraints. This means traders can maintain their positions for as long as they desire, providing unparalleled flexibility and strategic advantages.

Access for All: Retail Traders and Institutions

One of the remarkable aspects of EthosX's Perpetual Options is their inclusivity. Whether you're a seasoned institutional trader or an individual retail trader just dipping your toes into the world of derivatives, EthosX welcomes you. The platform has been designed to cater to a diverse range of participants, ensuring that anyone with an interest in derivatives can participate.

Seamless Trading Experience

EthosX places a premium on user experience. Navigating the world of derivatives can be intimidating, but EthosX aims to change that perception. Trading Perpetual Options on their platform is a straightforward process, thanks to user-friendly interfaces and intuitive tools. Even if you're new to derivatives trading, you'll find that EthosX makes the learning curve less daunting.

Your Guide to Trading Success

Worried about taking your first steps into trading Perpetual Options? Fear not. EthosX provides comprehensive instructions for trading on their platform. You can find step-by-step guidance on their website, ensuring that you have all the information you need to get started. With this level of support, even novice traders can confidently navigate the world of derivatives.

You might also be interested in: CreatorML and How It Works

EthosX: Pioneering the Future of Derivatives Trading

As we've journeyed through the world of EthosX and its Perpetual Options, it's clear that this platform is not just another player in the derivatives market; it's a game-changer. EthosX, driven by visionary founders Deepanshu and Smit Patoliya, is pushing the boundaries of what's possible in the world of finance.

A Visionary Approach

At the helm of EthosX, you'll find Deepanshu and Smit Patoliya, two individuals with a shared vision to transform the derivatives market. Their extensive backgrounds in quantitative finance have equipped them with the knowledge and expertise to pioneer innovative solutions. With a deep-rooted passion for blockchain technology and cryptocurrencies, they're on a mission to address the real-world problems that have plagued the financial markets for far too long.

The Blockchain Revolution

Blockchain technology serves as the foundation for EthosX's vision. It's the driving force behind their mission to eliminate inefficiencies and reduce risk in derivatives trading. By harnessing the power of blockchain, EthosX creates a transparent and secure environment where traders can engage with confidence. The blockchain's immutable ledger ensures that every transaction is recorded accurately, reducing the risk of disputes and errors.

An Inclusive Approach

EthosX is not just for institutional giants; it's for everyone. Whether you're a small retail trader or a major financial institution, EthosX welcomes you with open arms. They believe that democratizing derivatives trading is the key to a more equitable financial ecosystem. As they expand their offerings and integrate with traditional finance, the impact of EthosX on the derivatives market is poised to be nothing short of transformative.

Join the Revolution: EthosX and the Future of Derivatives Trading

In conclusion, EthosX isn't merely a platform; it's a harbinger of change in the derivatives trading landscape. With Perpetual Options already available on their testnet, they are rewriting the rules of the game. This platform, led by visionary founders and empowered by blockchain technology, promises to eliminate the inefficiencies that have plagued derivatives trading for far too long.

As EthosX continues to innovate and broaden its scope to encompass traditional finance, the derivatives ecosystem stands at the cusp of a revolution. The status quo is being challenged, and EthosX is leading the charge. Are you ready to be a part of this exciting evolution in derivatives trading? The future is here, and it's called EthosX.