Revolutionizing Financial Management: Fynt's AI-Powered Solution

In the fast-paced and data-driven world of business, financial management plays a crucial role in shaping a company's success. Yet, as companies scale, finance teams often find themselves drowning in a sea of manual tasks that hinder their ability to provide timely insights and drive strategic decision-making. This is where Fynt, the AI-powered financial controller, steps in. Founded in 2023 by Bulgarians Nick and Alex, Fynt aims to transform the way CFOs and financial controllers operate by streamlining processes, automating reconciliation, and empowering teams with actionable insights.

Unveiling Fynt: The Revolution of Financial Control with AI

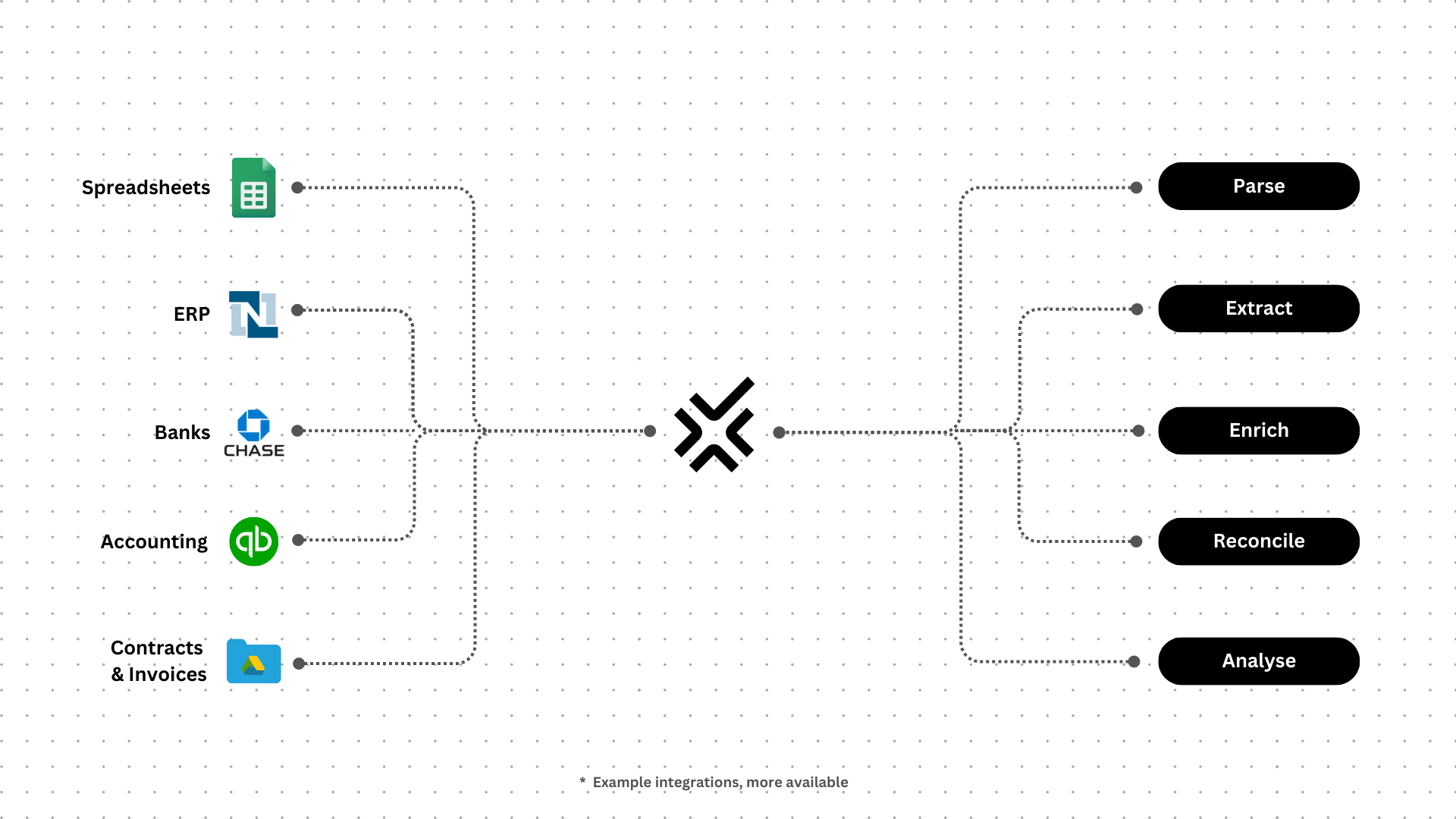

Imagine a financial realm where data dances effortlessly, decisions are fortified by the brilliance of AI insights, and generating reports is as smooth as a gentle breeze. Fynt materializes this captivating vision through its innovative launch as the AI Financial Controller. With a resolute commitment to empowering in-house finance teams, Fynt introduces an empowering platform that seamlessly integrates business bank accounts, accounting software, and ERPs. Yet, this integration transcends mere data transfer – it's an orchestrated symphony of efficiency, precision, and groundbreaking innovation. Fynt's ingenious technology takes the complexity out of financial documents, orchestrates automated invoice and bank reconciliation, and even stands ready to engage with your data inquiries, providing answers with lightning speed.

Navigating Financial Labyrinths: The Challenge of Manual Tasks and the Quest for Relief

As businesses embark on the exhilarating journey of scaling, they encounter a multifaceted challenge that mirrors their growth – the labyrinthine complexity of financial management. With each expansion and diversification, a web of financial intricacies is woven, demanding meticulous attention and management. However, this inevitable evolution doesn't come without its share of obstacles. Finance teams, the stalwart custodians of fiscal health, often find themselves ensnared in the intricate web of manual tasks that act as bottlenecks, hindering the pursuit of strategic objectives.

The orchestration of financial data is akin to an intricate ballet, with each step demanding painstaking effort. The arduous process of extracting and categorizing data from diverse sources is akin to a cryptic dance, where each move must be precise. Bank statements, invoices, and contracts – these are the rhythmic notes of this ballet. Yet, the harmony is often disrupted, as the dancers, in this case, finance professionals, grapple with the challenge of juggling data between spreadsheets, like performers struggling to maintain their graceful momentum.

As the financial crescendo builds towards the close of the fiscal period, the grand finale of month-end or year-end reporting looms, bringing with it a symphony of stress and chaos. What should be a triumphant conclusion transforms into a nerve-wracking ordeal. Finance teams, engulfed in a whirlwind of data reconciliation, bear the weight of a metaphorical headache. This figurative ailment, much like reaching for an aspirin, becomes a desperate plea for respite from the ordeal of manual tasks.

Fynt: The Catalyst for Financial Liberation and Empowerment

In the heart of this tumultuous financial landscape, a beacon of hope emerges in the form of Fynt, armed with a transformative arsenal of empowering technology. Fynt's mission is rooted in liberating finance teams from the clutches of spreadsheet-bound captivity and the monotonous routine of manual reconciliation. With the elegance of a maestro, Fynt orchestrates the integration of business bank accounts, accounting software, and ERPs, harmonizing these financial instruments into a symphony of streamlined efficiency.

At the core of Fynt's solution lies an intricate tapestry of advanced AI technology, interwoven with the threads of automation and data enrichment. This intricate weaving goes beyond mere automation; it elevates the very essence of financial data, enriching its quality and accuracy. The result is a dynamic interplay of information that fuels swifter decision-making and ushers in a new era of precise insights. This liberation from mundane tasks empowers finance teams to elevate their role, transforming them into strategic visionaries rather than operational jugglers.

Among the gems of Fynt's treasure trove of features shines the jewel of data-driven question-and-answer capability. Imagine the power of engaging with your financial data in a conversation, where queries are posed in natural language, and insightful responses flow seamlessly. No longer constrained by the arduous process of sifting through spreadsheets or waiting for exhaustive reports, finance professionals can obtain actionable insights at the speed of thought. Queries such as "How much did we spend on materials last quarter?" are met with rapid, precise responses, unlocking a realm of real-time financial understanding.

A Symphony of Success: Fynt's Tangible Impact on Business Realities

Venturing beyond theoretical realms, Fynt's impact resonates in the tangible successes of businesses spanning diverse industries. A striking example unfolds within the corridors of an electric car manufacturer, a company grappling with a mosaic of invoice formats and a deluge of purchase orders. In this intricate dance of financial transactions, Fynt steps in as the digital choreographer, seamlessly extracting vital information from a tapestry of files. The symphony of data unfolds as Fynt masterfully reconciles these fragments with bank statements and aligns them with sales contracts. An additional layer of brilliance is unveiled as custom categories of spending are artfully assigned, crafting a harmonious financial narrative. This real-world vignette underscores Fynt's adaptability and prowess, showcasing its ability to metamorphose and align with the unique contours of diverse business needs.

The Story Behind Fynt: From Frustration to Innovation

Every groundbreaking solution has a story, and Fynt's origin is rooted in real-life challenges. Co-founders Nick and Alex, both hailing from Bulgaria, have witnessed the struggles of financial management firsthand. Nick's upbringing around his parents' real estate business exposed him to the tireless efforts of manual reconciliation and spreadsheet manipulation. This experience was echoed when Nick and Alex embarked on their entrepreneurial journey, facing the same roadblocks that hindered their growth.

It was this shared frustration that sparked the idea for Fynt. Nick and Alex envisioned a world where business owners could focus on innovation and growth, unburdened by the overwhelming demands of financial management. Their firsthand experiences led them to create an AI-powered solution that not only streamlines operations but also fuels strategic decision-making.

Conclusion: A Future Redefined by Fynt

In the ever-evolving landscape of business, Fynt stands as a beacon of hope for finance teams burdened by manual tasks and data-related woes. By connecting crucial financial elements, automating reconciliation, and introducing AI-driven insights, Fynt empowers finance professionals to transcend mundane tasks and contribute to the strategic vision of their organizations. The story of Fynt is a testament to the power of innovation born from genuine challenges, and as Nick and Alex continue to revolutionize financial management, one can't help but anticipate a future where finance teams thrive and businesses flourish, thanks to Fynt's AI-powered prowess.