Unlocking Financial Security: nsave's Mission to Provide Offshore Accounts in Distressed Economies

In a world where economic stability can sometimes feel like an elusive dream, a group of visionary minds came together in 2021 to form nsave, a fintech startup with a mission to empower individuals in distressed economies by offering offshore accounts denominated in USD, EUR, and GBP. Founded by a trio of Rhodes Scholars with diverse backgrounds in governance, finance, and technology, nsave's journey is a testament to their commitment to creating a more inclusive global financial system. In this article, we will delve into the heart of nsave, exploring their founders, their innovative solution, and the impact they aim to achieve.

You might also be interested in: CreatorML and How It Works

Who Are the Minds Behind nsave?

Amer Baroudi: The Optimistic Visionary

Amer Baroudi, a Syrian-born entrepreneur and Rhodes Scholar, stands at the helm of nsave as its co-founder and CEO. With two degrees from the University of Oxford and a wealth of knowledge in governance, policy, and finance, Amer's journey has been nothing short of remarkable. He's not just a leader; he's an expert problem solver and a music composer in his secret life. Amer's unique blend of talents and experiences has played a pivotal role in shaping nsave's mission.

Abdallah AbuHashem: The Chess-Playing Scholar

Abdallah AbuHashem, a Rhodes Scholar hailing from Gaza, Palestine, joins Amer in co-founding Masref, a subsidiary of nsave. Abdallah, a Stanford alum with experience in Silicon Valley, brings a strategic edge to the team. When he's not busy revolutionizing the financial world, Abdallah enjoys playing chess, reading books, and indulging in his favorite TV shows. His multifaceted interests and global perspective add depth to nsave's mission.

Edward Yee: The Adventurous Innovator

Edward Yee, the co-founder of nsave and Givfunds, is another Rhodes Scholar and a World Economic Forum Global Shaper. Recognized with accolades like Forbes 30U30 and the Commonwealth Youth Award, Edward's adventurous spirit and passion for collecting stories from around the world are driving forces behind nsave's quest for change. From standing on Bangladeshi train tops to rappelling down Vietnamese waterfalls, Edward's zest for life is reflected in nsave's mission to empower individuals.

Together, Amer, Abdallah, and Edward are the embodiment of nsave's values, collectively boasting experience in banking, regulatory compliance, and technology, having previously worked with industry giants such as Microsoft and Robinhood.

You may also be interested in: Delving into the Cadence Concept in Business

The Genesis of nsave: Empowering Distressed Economies

What is nsave's Core Offering?

nsave's flagship offering, Masref, provides offshore USD accounts to individuals living in countries plagued by high inflation and a crumbling banking system. The primary objective of Masref is to safeguard the savings of these individuals, offering them a safe haven for their hard-earned money.

Why Masref?

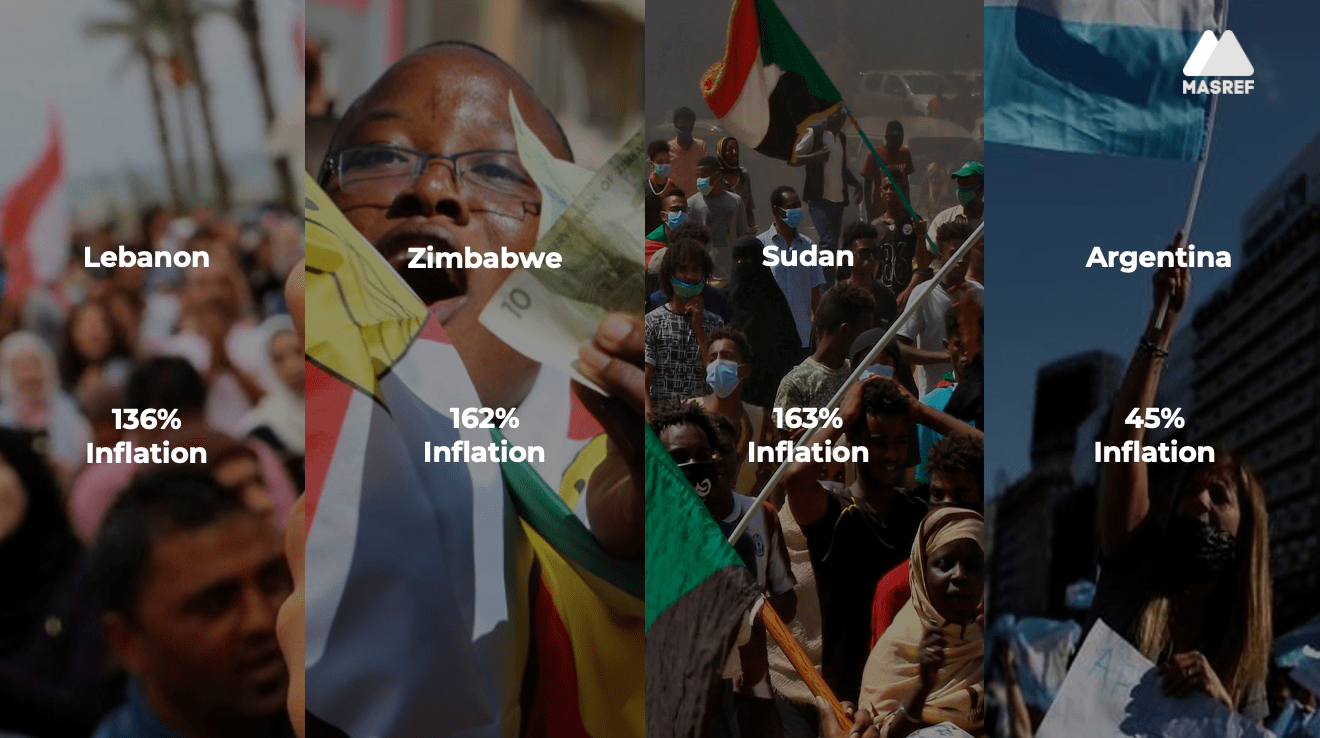

Inflation can erode the value of money at an alarming rate, leaving individuals in dire need of financial stability. Take Lebanon, for instance, where residents grapple with a staggering 140% inflation rate. In such an environment, saving in USD becomes a lifeline, a means to preserve wealth. However, local banks in countries like Lebanon have proven to be unreliable, with stories of frozen and stolen funds haunting the populace.

This is where Masref steps in. It offers a lifeline to those trapped in hyper-inflated economies, granting them access to offshore USD accounts with the same level of security that was traditionally reserved for High Net-worth Individuals (HNIs). The same narrative unfolds in other distressed economies like Argentina, Zimbabwe, Sudan, and many more.

The Personal Connection: A Driving Force

Amer Baroudi, the CEO of nsave, shares a personal connection to the mission of Masref. Witnessing his father lose his life savings due to rampant inflation during their flight from Syria was a heart-wrenching experience. He also saw firsthand the challenges his father faced in trying to secure a bank account abroad. It was a stark reminder of the financial inequalities prevalent in the world.

Amer's determination to change this unfair reality became the catalyst for Masref's creation. His personal story resonates with countless individuals facing similar challenges, inspiring hope and driving nsave's mission forward.

Masref: Empowering the Unbanked

How Does Masref Work?

Masref offers a straightforward yet powerful solution to individuals in distressed economies. It provides offshore USD accounts, allowing people to store and protect their wealth in a stable currency. By doing so, Masref shields these individuals from the devastating impact of hyperinflation and unreliable local banking systems.

Breaking Down the Benefits

Financial Stability: The core benefit of Masref is the financial stability it offers. In economies where the local currency is rapidly depreciating, having savings denominated in USD can be a game-changer. It provides a hedge against inflation, ensuring that hard-earned money retains its value.

Security: Masref's offshore accounts come with robust security measures, ensuring that individuals' funds are safe from the vulnerabilities of local banks. This level of security was previously accessible only to the wealthiest individuals.

Accessibility: nsave's mission is to make financial security accessible to all. Masref's user-friendly platform ensures that individuals can open and manage their offshore accounts with ease, regardless of their financial expertise.

A Beacon of Hope for Distressed Economies

Masref doesn't just offer financial services; it offers hope. It empowers individuals to take control of their financial futures, providing a lifeline in times of economic turmoil. It's a beacon of hope for those who have long felt excluded from the global financial system.

You may also like: Hire WooCommerce Developer

The Future of nsave: A Global Impact

What Lies Ahead for nsave?

nsave's journey has only just begun. As it continues to expand its reach and impact, the startup aims to:

Broaden Its Offering: While Masref focuses on offshore USD accounts, nsave envisions expanding its services to include EUR and GBP accounts. This expansion will provide even more options for individuals seeking financial stability.

Global Outreach: nsave is committed to reaching individuals in distressed economies around the world. Its mission extends beyond geographical boundaries, making it a global force for financial inclusion.

Education and Empowerment: nsave recognizes that true change goes beyond offering financial services. The startup aims to educate individuals in distressed economies about financial literacy, enabling them to make informed decisions and take charge of their financial destinies.

Impact on Distressed Economies

The impact of nsave's mission is profound. By providing individuals with the tools they need to protect their wealth, nsave contributes to economic stability in distressed economies. This, in turn, can lead to greater social and political stability, creating a ripple effect of positive change.

A Call to Action

nsave's journey is a call to action for the global community. It reminds us that financial inclusion is not a luxury but a fundamental right. It challenges the status quo and asks us to imagine a world where everyone has access to the financial security they deserve.

You may also like: Your Guide to Web Developer Salaries

Conclusion: Transforming Lives, One Account at a Time

In a world where economic disparities persist, nsave stands as a beacon of hope. Founded by three visionary Rhodes Scholars with diverse backgrounds and a shared commitment to change, nsave's mission is clear: to provide offshore accounts denominated in stable currencies to individuals in distressed economies. Through Masref, nsave empowers the unbanked, offering them financial stability, security, and hope.

As nsave continues to expand its reach and impact, its story serves as a reminder that positive change is possible, even in the face of daunting challenges. It calls upon us to envision a world where financial security is not a privilege but a right. nsave is transforming lives, one account at a time, and in doing so, it is reshaping the future of global finance.