Charting a New Course: NowHouse's Journey Towards Modernizing Post-Trade Processing

In the dynamic and fast-paced realm of stock trading, every moment holds immense value. Within this intricate landscape, the emergence of NowHouse stands as a pivotal moment—a testament to the power of vision and innovation. Spearheaded by the forward-thinking Dhaval Gajiwala, NowHouse embarks on a journey poised to redefine post-trade processing for stock brokerages. But what prompted Dhaval to embark on this transformative endeavor? What sparks ignited the flame that would become NowHouse? To unravel the compelling narrative behind NowHouse's genesis, one must delve deep into its roots, exploring the driving forces that set it on its path of innovation and change.

Charting the Course: A Visionary Odyssey Toward Transformation

Picture a world where the intricate complexities of stock trading seamlessly coalesce, where transactions settle in the blink of an eye—a world envisioned by NowHouse. Dhaval Gajiwala's vision extends far beyond mere transactional efficiency; it encompasses a grander ambition—to establish NowHouse as the preeminent system of record for broker-dealers and regulatory bodies alike. Envision NowHouse as more than just a solution provider; envision it as the cornerstone of a revolution, meticulously overseeing the colossal volume of shares exchanged annually within the U.S. market. But how does NowHouse navigate the vast expanse between vision and reality? What strategies and innovations will it employ to manifest this audacious vision into tangible, transformative change? Let us embark on a journey through the depths of NowHouse's strategic blueprint, unraveling the intricate tapestry of ambition and innovation that charts its course toward a future defined by efficiency, transparency, and progress.

Understanding the Imperative: Unveiling the Urgency for Instant Settlement

In the aftermath of groundbreaking events like the WallStreetBets phenomenon, the necessity for instant settlement looms large on the horizon, casting a spotlight on the fundamental flaws of traditional systems. These systems, burdened by their convoluted reconciliation processes, find themselves struggling to maintain pace with the relentless cadence of modern trading. NowHouse, astutely attuned to the pulse of the financial sector, discerns this pressing need for agility and efficiency, positioning itself as the vanguard of transformation. But what precisely fuels this demand for instant settlement? What underlying forces propel NowHouse forward in its quest to redefine the dynamics of post-trade processing?

Deciphering the Complexity: Unraveling the Intricacies of Reconciliation

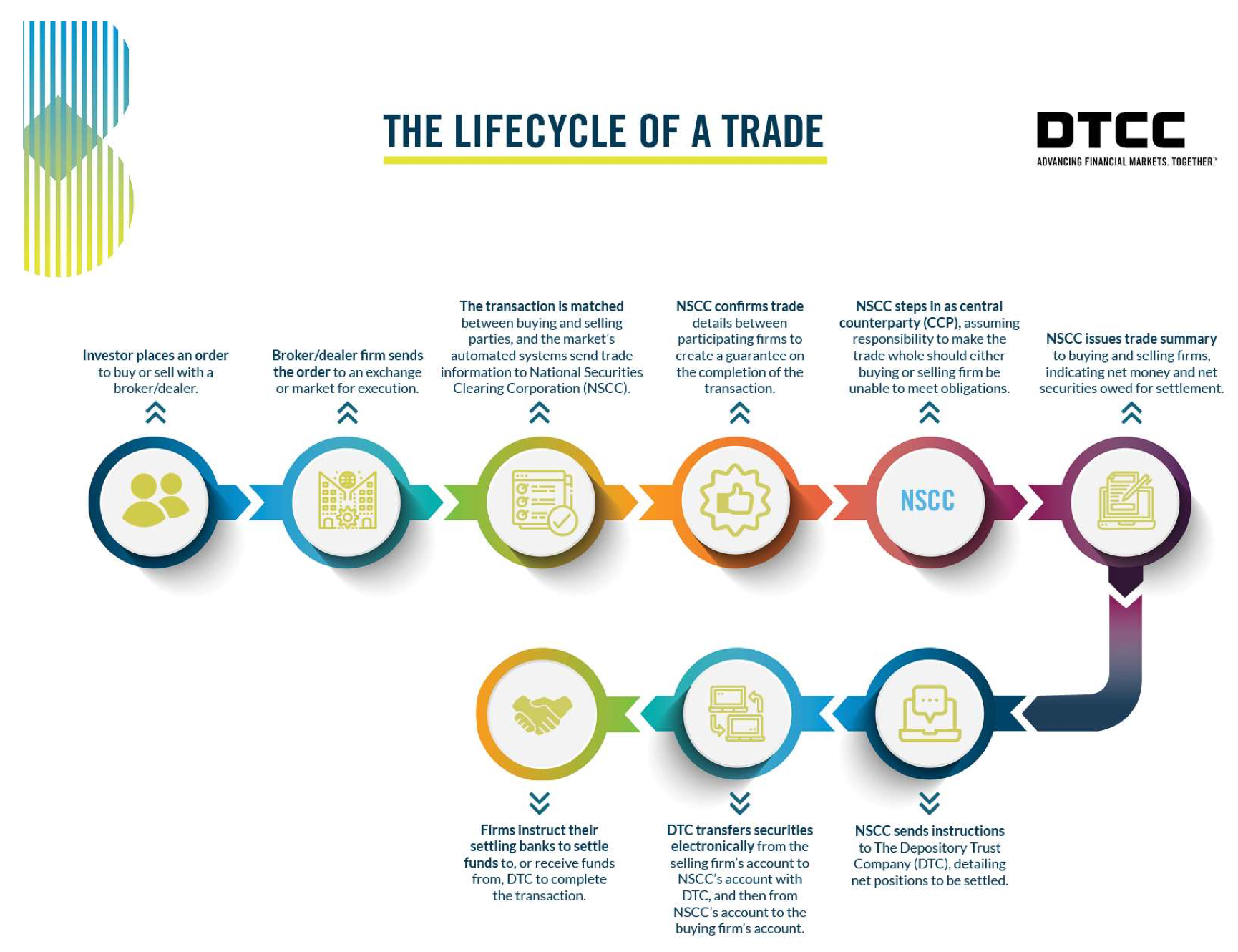

At the core of post-trade processing resides the labyrinthine conundrum of reconciliation—a formidable challenge that demands meticulous attention to detail. Each trade, every transaction must undergo a rigorous process of matching and verification—a herculean feat amidst the tumultuous currents of high-frequency trading and volatile market fluctuations. Traditionally, reconciliation has been a labor-intensive endeavor, fraught with the pitfalls of human error and operational delays. How does NowHouse propose to navigate this intricate web of complexity and pave the way for a new era of efficiency and effectiveness? What innovative strategies and technologies will NowHouse employ to unravel the intricacies of reconciliation and forge a path toward seamless post-trade processing? Let us embark on a journey of discovery, peeling back the layers of complexity to uncover the transformative potential that lies at the heart of NowHouse's vision.

Navigating the Terrain: Pioneering Technological Advancements

In a landscape characterized by archaic manual processes and antiquated systems, NowHouse emerges as a beacon of technological innovation, heralding a new era of efficiency and effectiveness in post-trade processing. Through the strategic deployment of advanced AI-driven algorithms, NowHouse embarks on a mission to redefine the very essence of trade reconciliation. No longer shackled by the constraints of laborious manual reconciliations, NowHouse empowers trading operations teams to transcend traditional boundaries, leveraging automation to streamline processes and enhance productivity. But what distinguishes NowHouse from conventional reconciliation methodologies? What innovative features and functionalities lie at the heart of its transformative approach?

Unraveling the Innovation: Delving into NowHouse's Technological Arsenal

At the core of NowHouse's technological prowess lies a sophisticated array of AI-driven algorithms, meticulously engineered to navigate the complexities of post-trade reconciliation with unparalleled precision and efficiency. By harnessing the power of machine learning and predictive analytics, NowHouse transcends the limitations of traditional reconciliation methods, offering a dynamic and adaptive solution tailored to the unique needs of each brokerage firm. From intelligent pattern recognition to real-time data analysis, NowHouse's technological arsenal encompasses a diverse range of capabilities designed to revolutionize the way trades are reconciled. But perhaps most importantly, NowHouse's commitment to continuous innovation ensures that its platform remains at the forefront of technological advancement, poised to adapt and evolve in response to the ever-changing demands of the financial landscape.

Seizing the Opportunity: Embracing the Shift to T+1 Settlement

As regulatory frameworks evolve and market dynamics undergo rapid transformation, NowHouse seizes upon the opportune moment presented by the transition to T+1 settlement. With the Securities and Exchange Commission (SEC) decreeing a shorter trade settlement cycle, the imperative for efficient post-trade processing has never been more pronounced. Recognizing the critical role it plays in facilitating this transition, NowHouse positions itself as a stalwart ally for brokerages seeking to navigate the complexities of the changing regulatory environment. By offering a comprehensive suite of solutions tailored to the unique requirements of T+1 settlement, NowHouse ensures that brokerages can seamlessly adapt to the evolving landscape, safeguarding their operational integrity and competitive advantage in an era defined by rapid change and unprecedented innovation. But how does NowHouse position itself to capitalize on this monumental shift? What strategic initiatives and partnerships does it undertake to position itself as a trusted partner for brokerages embarking on the journey toward T+1 settlement? Let us delve deeper into NowHouse's strategic blueprint, unraveling the intricacies of its approach and uncovering the transformative potential that lies at the intersection of technology and regulation.

Embracing the Future: A Vision Realized

In the ever-evolving world of finance, NowHouse emerges as a guiding light—a testament to the power of innovation and ingenuity. With its sights set on becoming the system of record for the U.S. market, NowHouse embarks on a journey fraught with challenges and opportunities. But armed with vision, technology, and unwavering determination, NowHouse is poised to reshape the future of post-trade processing, one trade at a time.

Conclusion: A New Chapter Unfolds

As the financial landscape undergoes unprecedented transformation, NowHouse stands at the forefront of change. With its visionary founder and innovative approach, NowHouse embodies the spirit of progress and possibility. The journey ahead may be fraught with challenges, but with NowHouse leading the way, the future of post-trade processing looks brighter than ever before. Join NowHouse as it charts a new course for the financial sector and unlocks the potential of instant settlement.