Transforming the Landscape of Cross-Border Payments: The Ping Startup Journey

In the ever-evolving landscape of fintech, one startup is making waves in the world of cross-border payments. But what makes Ping tick? Let's delve into the background and meet the founders who are on a mission to simplify international payments for freelancers and contractors.

Mary Saracco - The Visionary Leader

Meet Mary Saracco, the driving force behind Ping. Her bold goal? To revolutionize international payments and make them as effortless as sending an email. With a background as an M&A Investment Banker at UBS and experience at the World Bank, she brings a wealth of financial knowledge to the table.

Pablo Orlando - The Innovator Extraordinaire

Pablo Orlando, another co-founder of Ping, has earned his stripes as one of the top Innovators in Latam under 35, a distinction bestowed upon him by MIT. With over 16 years of experience in fintech and e-commerce in LATAM, he is the creative mind shaping Ping's innovative solutions.

Nicolas Bayerque - The Fintech Architect

Nicolas Bayerque, Ping's co-founder and COO, comes with a background in payment processing, digital banking, and crypto. He co-founded Latamex (Settle Network), laying the foundation for the first fiat-to-crypto gateway in Latin America. Nicolas's expertise extends to building regulated payments infrastructure across Argentina, Brazil, and Mexico, making him a pivotal figure in Ping's journey.

Jack Saracco - The Crypto Visionary

Jack Saracco, an integral part of the Ping team, has a rich history of leadership in the crypto industry. His leadership in expanding LatamEx and creating the first Latin American stablecoin cements his status as a pioneer in the crypto world.

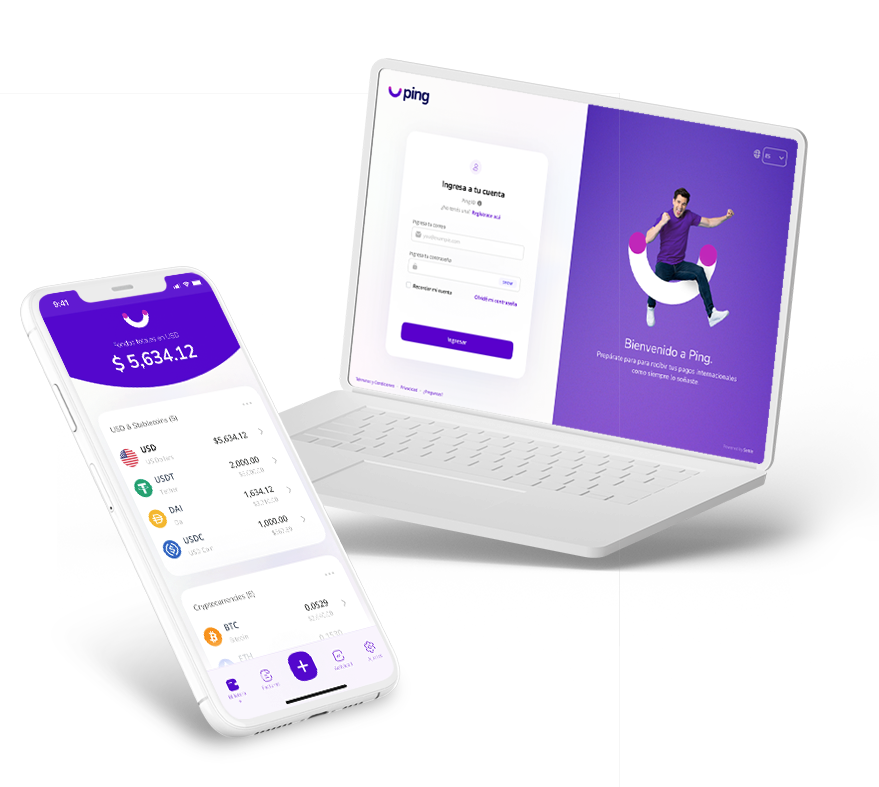

The Emergence of Ping - A Neo Bank for Remote Workers

In the year 2021, a groundbreaking solution emerged on the global financial landscape – Ping. This innovative platform marked a turning point for remote workers around the world, offering them an unprecedented level of financial empowerment. But what precisely is Ping, and how does it serve as a catalyst for the financial independence of freelancers and contractors?

Ping isn't just another fintech startup; it's a revolutionary neo bank designed to cater to the unique needs of remote workers. In an era where the gig economy is flourishing, Ping provides an indispensable toolkit that allows individuals to seize control of their financial destinies like never before.

At its core, Ping offers a comprehensive suite of financial services that cater specifically to the needs of remote workers. This includes the provision of personal Dollar accounts in the United States, a crypto account, and a seamless invoicing system to facilitate getting paid for one's services. In essence, Ping transforms the way remote workers manage their finances, enabling them to earn more and receive payments promptly.

Addressing the Thorny Issue: The Problem Ping Solves

Before Ping's arrival on the scene, remote workers and freelancers were trapped in a convoluted web of financial processes. Accessing their earnings from contractors required navigating through a labyrinthine network of platforms and intermediaries, a process that was both costly and time-consuming. It's in this intricate maze that Ping steps in as a beacon of hope.

The precise problem that Ping addresses is the fragmentation and complexity of cross-border payments for remote workers. In a world where freelancers collaborate with clients from various corners of the globe, handling payments should be seamless and efficient. However, the reality often involved multiple intermediaries, high fees, and lengthy processing times.

Ping recognized this challenge and embarked on a mission to simplify cross-border payments. It's a mission born out of the understanding that remote workers deserve a smoother, more streamlined process for accessing their hard-earned money. By resolving this predicament, Ping empowers diligent workers to focus on their craft and not get bogged down in financial intricacies.

The Ping Approach: Bridging the Divide

Ping's approach to cross-border payments is nothing short of revolutionary. It's not merely a solution; it's a game-changer that redefines the entire process. Ping's core value proposition lies in providing an all-encompassing platform that eliminates the need for multiple intermediaries and simplifies every facet of cross-border financial transactions.

Imagine having the ability to generate invoices, receive payments in USD, manage international transfers, convert funds to local currencies, and even delve into the world of cryptocurrencies and stablecoins—all within a single platform. This is precisely what Ping offers to its users.

The magic of Ping lies in its seamless integration of diverse financial services. Users can effortlessly generate professional invoices tailored to their needs, simplifying the billing process. They can receive payments in USD directly to their Ping accounts, eliminating the need for complex intermediary banks. Ping also facilitates international transfers, making it a breeze to collaborate with clients worldwide. Additionally, users can convert funds to local currencies with ease, ensuring they have access to their money when and where they need it.

But Ping doesn't stop there. It goes a step further by embracing the world of cryptocurrencies and stablecoins. This forward-thinking approach positions users at the forefront of financial innovation, enabling them to explore the opportunities presented by digital assets.

By bridging the divide between traditional and digital finance, Ping empowers its users with unprecedented control over their financial lives. It simplifies cross-border payments, reduces fees, and enhances the overall financial experience, making it a compelling choice for remote workers and freelancers.

The Ping Advantage - More Earnings, Swifter Transactions

Choosing Ping over traditional payment solutions is akin to opening the door to a world of financial advantages. The statistics speak for themselves: Ping users report an average increase in earnings of 4%, and payments are processed and received on the same day. But what sets Ping apart, making it the go-to choice for international contractors and freelancers?

The Ping advantage goes beyond just numbers—it's a holistic transformation of the way individuals manage their finances. One key distinction is the speed of transactions. With Ping, gone are the days of waiting for days or even weeks for payments to clear. The platform ensures that funds are available promptly, allowing users to access their hard-earned money exactly when they need it.

Furthermore, the financial benefits of Ping extend to higher earnings. The 4% increase reported by users is a testament to the platform's ability to optimize payments and minimize fees. This translates to more money in the pockets of freelancers and contractors, enabling them to focus on their work rather than navigating the intricacies of financial systems.

What truly distinguishes Ping from conventional solutions is its user-centric design. It places control back in the hands of the remote worker, streamlining processes, reducing costs, and enhancing the overall financial experience. In essence, Ping isn't just a payment platform; it's a gateway to financial empowerment for remote workers in the digital age.

A Global Reach from the Heart of Buenos Aires

While Ping's headquarters are nestled in Buenos Aires, Argentina, its impact knows no bounds. How does the company's location contribute to its success, and what implications does it have for users worldwide?

Charting the Course Forward: Ping's Vision

As Ping continues to rewrite the rules of cross-border payments, what is its vision for the future? How will this innovative startup continue to shape the financial experiences of freelancers and contractors as they navigate the global gig economy?

Join the Movement: Become a Part of the Ping Revolution

Are you a freelancer or contractor fatigued by the complexities of cross-border payments? The time is ripe to align yourself with the Ping revolution. Discover how Ping can redefine your financial experience, empowering you to excel in the global gig economy.

A New Era in Cross-Border Payments Beckons

In conclusion, Ping isn't just a startup; it's a transformative force in the realm of cross-border payments. With visionary leaders like Mary Saracco, Pablo Orlando, Nicolas Bayerque, and Jack Saracco at the helm, Ping is primed to redefine how freelancers and contractors access their earnings, streamlining processes, reducing costs, and empowering workers on a global scale. The Ping revolution beckons—join it today and experience the future of cross-border payments.