Where Sports Meet Finance: The Rise of Strike

Strike was founded in 2024 by Ronit, Ankit, and Aarav, three innovators with a shared vision: to reshape the nature of betting into something far more intelligent, scalable, and investable. Operating from San Francisco, the team joined Y Combinator’s W25 batch under the guidance of primary partner Harj Taggar. Their collective goal? To elevate betting beyond binary entertainment into a mature financial instrument — a true asset class.

The team draws inspiration not just from the world of gaming and fantasy sports, but from financial markets. Their unique mix of domain expertise and technical acumen allows them to reimagine the way betting is structured, priced, and traded. With Strike, they’re not just launching a platform — they’re spearheading a movement.

What Is the Core Problem Strike Is Solving?

Traditional betting platforms are simplistic in their structure, relying heavily on binary outcomes — win or lose, all or nothing. Whether it’s sports betting apps like DraftKings or even decentralized prediction markets such as Polymarket or Kalshi, the underlying problem remains: payouts are fixed, and rarely reflect the nuance of a bettor’s conviction or accuracy.

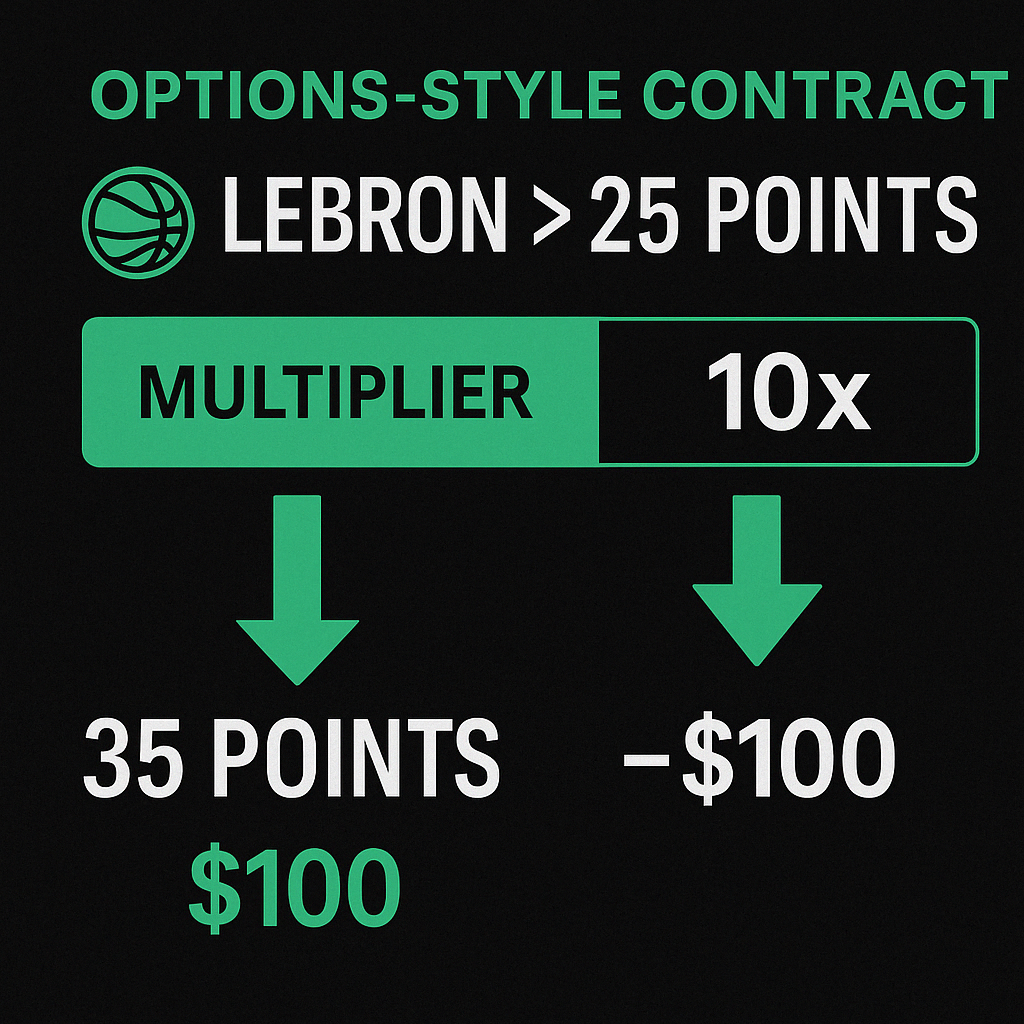

Consider a basketball fan betting that LeBron James will score more than 25 points. On most platforms, whether he scores 26 or 50, the payout is the same. Worse still, the reward rarely justifies the risk — a bettor’s stake often outweighs the potential winnings. This kind of structure limits engagement, disincentivizes high-confidence bets, and reduces the entire system to a game of chance rather than one of strategy or insight.

For a world increasingly driven by data, analytics, and probabilistic thinking, this old model feels outdated.

How Does Strike Offer a Better Betting Model?

Strike introduces continuous betting — a breakthrough model that pays users based on how right they are, not just whether they’re right. Instead of receiving a flat payout, users earn (or lose) proportionally to the outcome. This structure mimics financial derivatives, where the return is based on the magnitude of the underlying event.

Let’s revisit the LeBron example. A user believes he’ll score over 25 points and chooses a 10x multiplier. If LeBron scores 35, the user earns $100 — that’s 10 points above the line times the 10x multiplier. If he scores only 15, the user loses $100.

This system aligns incentives and creates an ecosystem where skill, analysis, and conviction are rewarded. Bettors now have the tools to craft higher-return positions with tailored risk profiles, much like investors do in financial markets.

How Does Strike Maintain Platform Stability?

While Strike empowers users to make outsized gains, it also protects the platform’s integrity using proprietary models. Their in-house engine dynamically adjusts betting lines and maintains a 3-5% edge per bet. This built-in mechanism acts like a market maker’s spread in financial trading, ensuring liquidity, risk management, and consistent revenue.

This balance between user upside and platform profitability is essential for long-term viability. Strike isn't merely a betting app; it’s a precision-calibrated financial engine.

What Is Strike’s Long-Term Vision?

Strike’s ambitions stretch far beyond fantasy sports. The company envisions a future where betting operates as a fully-fledged prediction market exchange — one that supports a wide array of financial derivatives such as options, swaps, and synthetic contracts. In this environment, users can not only bet but also trade prediction contracts, taking on the roles of speculators, market makers, and liquidity providers.

The transition from a closed betting platform to an open, peer-to-peer exchange unlocks enormous potential:

- Higher trading volumes

- Algorithmic and high-frequency strategies

- Broader market categories (e.g., politics, weather, finance)

- Institutional participation

By drawing parallels with mature financial markets, Strike is preparing for a world where betting is no longer seen as gambling, but as a legitimate asset class ripe for investment.

How Will Strike Redefine Prediction Markets?

Strike’s model retools the very mechanics of prediction markets. Instead of dealing in probabilities alone, users interact with derivative-style contracts, creating financial instruments based on future outcomes. These instruments can be structured with varying levels of exposure, risk, and complexity, from straightforward over/under multipliers to custom volatility plays.

Imagine applying this to real-world events:

- A trader bets on the likelihood of a political candidate gaining approval ratings above 55%.

- Another places a swap on cryptocurrency adoption metrics.

- Others hedge against weather patterns, concert attendance, or AI model benchmarks.

This kind of diversity opens up new frontiers in forecasting and hedging, effectively enabling the financialization of real-world uncertainty.

What Sets Strike Apart from Other Betting Platforms?

Strike’s key differentiators are structural, strategic, and philosophical:

- Structural: Its continuous payout model rewards precision, not just correctness.

- Strategic: By evolving toward a full-blown exchange, Strike positions itself at the intersection of fintech and gamification.

- Philosophical: It treats bettors not as gamblers, but as informed speculators — empowering them with tools once reserved for professional traders.

In essence, Strike is rewriting the rules of betting, challenging centuries-old conventions, and aligning them with the sophistication of modern markets.

Who Can Benefit from Strike’s Platform?

Strike is designed for:

- Daily Fantasy Sports Players: Seeking deeper engagement and higher rewards based on their player knowledge.

- Data Analysts and Quants: Looking to apply models and predictive algorithms to real-world outcomes.

- Retail Traders: Eager to diversify into alternative asset classes beyond stocks and crypto.

- Institutions: Exploring prediction markets as hedging instruments or alpha-generating opportunities.

By bridging consumer betting with professional-grade trading mechanics, Strike offers value to a wide spectrum of users.

Why Could Strike Be a Turning Point in Betting History?

Strike isn’t just another startup in the betting world — it’s part of a much larger movement to legitimize, de-stigmatize, and professionalize prediction-based financial activity. By starting with sports and fantasy — a familiar domain with high engagement — Strike builds the foundation for broader financial adoption.

It represents a cultural and economic shift: one where betting becomes quantifiable, investable, and respected. In the same way options markets transformed trading, Strike aims to transform how people think about risk and reward in the context of real-world events.

If successful, Strike could be to prediction markets what Coinbase was to crypto or what Robinhood was to retail investing — a game-changer that redefines the industry.

Conclusion: Is Strike the Future of Betting and Beyond?

Strike is not merely refining sports betting — it’s redefining it. Through the use of continuous contracts, advanced modeling, and plans for a peer-to-peer derivatives exchange, the startup is transforming how people engage with predictions.

By combining the thrill of sports with the intelligence of financial engineering, Strike is creating an entirely new category — where insight is capital, and betting becomes a viable economic instrument. If the vision materializes, we won’t just see more sophisticated betting tools — we’ll witness the birth of an entirely new asset class.