Unlocking Payment Flexibility: The BlueHill Payments Startup

In an era where digital payments have become the norm, businesses face a multitude of challenges in managing their revenue operations efficiently. From high processing fees to juggling multiple payment systems, these hurdles hinder their growth potential. But what if there were a solution that could streamline payment processes, reduce costs, and offer unprecedented flexibility to merchants? Welcome to the world of BlueHill Payments, the startup founded in 2022, with a mission to transform the way businesses handle transactions.

Who Are the Minds Behind BlueHill?

Founders: Himanshu Minocha and Rohan Minocha

Every great startup begins with visionary founders, and BlueHill Payments is no exception. Meet Himanshu Minocha, the CEO, and Rohan Minocha, the Co-Founder and CTO, the dynamic duo behind this innovative venture.

Himanshu Minocha, with a background in computer science from the University of Illinois at Urbana-Champaign, has an impressive track record even before launching BlueHill. As a teenager, he worked on numerous hardware and software projects that resulted in active patents. His blend of technical prowess and entrepreneurial spirit sets the tone for BlueHill's success.

Rohan Minocha, the Co-Founder and CTO, is currently pursuing computer science at Stanford University. His technical acumen and dedication to innovation make him the perfect counterpart to Himanshu's vision.

You may also like: Hire WooCommerce Developer

The Genesis of BlueHill Payments

A Marketplace for Payment Processors

BlueHill Payments is a pioneering platform designed to expand payment flexibility for merchants while significantly lowering credit card processing rates. Launched in 2022, this startup has already caused ripples in the fintech industry by addressing a critical pain point for businesses - the cost and complexity of payment processing.

Why BlueHill Payments Matters

Why are Payment Processing Woes a Big Deal?

Expensive Transaction Fees: High processing fees eat into businesses' profits, especially as they scale up.

Vendor Lock-In: Using multiple tools and software leads to vendor lock-in, limiting a business's flexibility.

Lack of Analytics: It's challenging to gather comprehensive lifecycle analytics when working with multiple payment service providers.

The BlueHill Solution

Can BlueHill Payments Simplify Your Payment Process?

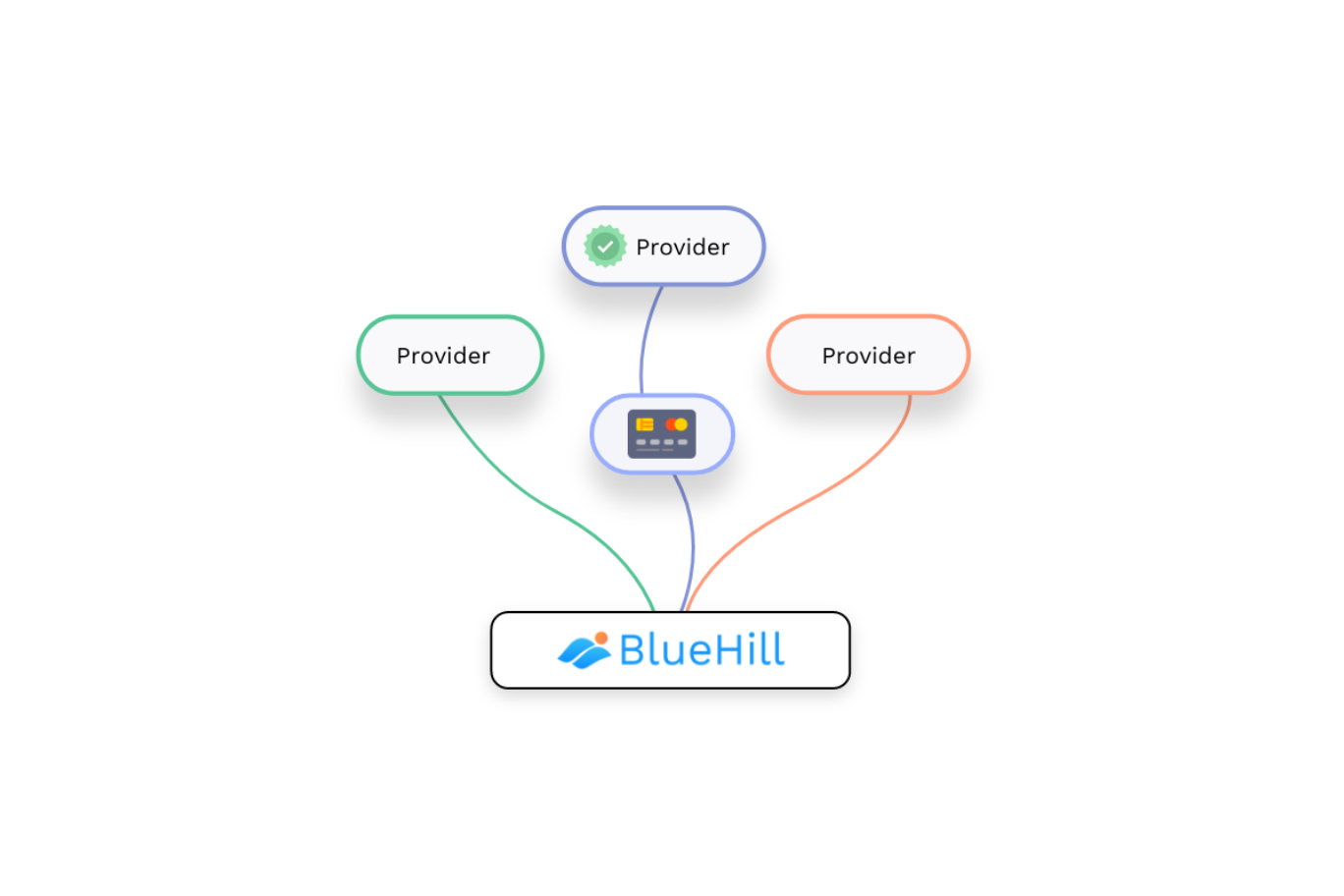

BlueHill Payments acts as an intelligent gateway routing platform that offers a solution to these pressing issues. It achieves this by automatically reducing transaction fees and routing transactions to different gateways based on various parameters. But how exactly does it work?

The Magic of Intelligent Routing

Imagine having access to a marketplace for payment processors. That's precisely what BlueHill is. It's an intelligent routing platform that optimizes payment processing for merchants. By analyzing parameters such as transaction type, payment method, and more, it routes transactions to the most cost-effective gateway. This means that merchants get access to a wider variety of alternative payment methods while simultaneously lowering their fees.

Benefits at a Glance

Lower Fees: Enjoy reduced transaction fees without compromising on payment options.

Improved Transaction Clearance: Enhance your transaction clearance rate.

Streamlined Connectivity: Easily connect to different payment service providers.

Best Rates Guaranteed: BlueHill integrates with various payment gateways to offer you the best rates across all payment options for each transaction.

You may also be interested in: Delving into the Cadence Concept in Business

Unveiling the BlueHill Advantage

In the ever-evolving landscape of fintech startups, standing out is no small feat. BlueHill Payments has accomplished precisely that by offering a comprehensive suite of features tailored to suit businesses of all sizes. Let's dive into what sets BlueHill apart and makes it a beacon of innovation in the industry.

All-in-One Revenue Management: Revolutionizing the Way You Operate

Imagine having the power to manage all aspects of your revenue and transactions from a single, unified platform. BlueHill Payments transforms this dream into reality. Bid farewell to the arduous task of juggling multiple systems. With BlueHill, your revenue management becomes a seamless, consolidated experience, enhancing your operational efficiency.

Not only does this feature simplify your workflow, but it also allows you to gain a comprehensive view of your financial health. All your revenue-related data is at your fingertips, making strategic decision-making a breeze.

Vendor Freedom: A World of Possibilities

Vendor lock-in can be a stifling factor for businesses seeking flexibility and cost optimization. BlueHill Payments understands the importance of choice. That's why it seamlessly integrates with your existing payment service providers, granting you the freedom to continue using the solutions that work best for your business.

This unique capability empowers you to explore a wide range of payment options while keeping the services you trust. BlueHill's compatibility with your current setup ensures a smooth transition, eliminating the need for costly system overhauls.

Real-time Insights: A Window into Your Success

Data is the lifeblood of modern businesses, and BlueHill Payments recognizes its significance. With BlueHill, you gain immediate access to invaluable insights that can propel your business forward.

Imagine having a real-time dashboard that provides you with customer transaction history, lifetime value (LTV) data, and live revenue graphs. This wealth of information allows you to make informed decisions on the fly. Whether it's tracking customer behavior, assessing the performance of your payment methods, or identifying growth opportunities, BlueHill's real-time insights are your key to success.

Time and Cost Efficiency: Streamlining Your Operations

In the fast-paced world of business, time is money, and efficiency is paramount. BlueHill Payments understands this and has designed a user-friendly Dashboard and API that prioritize your time and resources.

With BlueHill, you can bid adieu to manual, time-consuming processes. The user-friendly Dashboard simplifies the complexities of payment management, making it accessible to users of all skill levels. Alternatively, for those who prefer a more hands-on approach, BlueHill's API provides direct access to its powerful capabilities. This versatility ensures that whether you're tech-savvy or just getting started, BlueHill offers a seamless experience tailored to your needs.

You may also like: Your Guide to Web Developer Salaries

Navigating the Waters of Intelligent Routing

The heart of BlueHill Payments lies in its intelligent routing platform. It's not just about simplifying payment processing; it's about empowering businesses with a dynamic tool that caters to a diverse range of payment-related needs. Let's delve deeper into the profound advantages of this intelligent routing system:

Fast Settlements: Accelerating Your Revenue Flow

In the competitive business world, speed is often the name of the game. BlueHill's intelligent routing ensures that your transactions are processed swiftly. This means you can access your hard-earned revenue more quickly, enabling better cash flow management and reducing the time you spend waiting for funds to hit your account.

Imagine the advantage of having access to your revenue within hours rather than days. BlueHill's fast settlements can provide your business with a significant edge.

Lower Fees: Maximizing Your Profit Margins

High transaction fees can eat into your profits and hinder your growth. BlueHill Payments tackles this problem head-on by intelligently routing transactions to minimize processing fees. This strategic approach to payment processing results in substantial savings for your business.

Every dollar saved on processing fees is a dollar that can be reinvested in your operations or passed on as savings to your customers, potentially increasing your competitiveness in the market.

Tiered Billing: Tailoring Payment Processes to Your Needs

Every business is unique, and so are its billing needs. BlueHill's routing system is remarkably flexible, allowing you to tailor your billing processes to align with your specific business priorities.

Whether you require tiered billing for different customer segments, custom pricing models, or other billing intricacies, BlueHill has the capability to adapt to your requirements. This level of customization ensures that your payment processing aligns seamlessly with your business strategy.

Easy-to-Use Dashboard and API: A Solution for Every Skill Level

At BlueHill, accessibility is paramount. Whether you're a tech-savvy professional or just beginning your journey in the world of digital payments, BlueHill offers a solution that suits your preferences.

For those who prefer a user-friendly approach, the Dashboard simplifies the complexities of intelligent routing, making it accessible to users of all levels of expertise. On the other hand, the direct API access provides a hands-on experience for businesses seeking more control over their payment processes.

In conclusion, BlueHill Payments doesn't just offer a solution to payment processing; it revolutionizes the way businesses manage their revenue. With an array of innovative features and the power of intelligent routing, BlueHill empowers businesses to optimize their operations, reduce costs, and stay ahead of the competition in a rapidly evolving digital landscape. As BlueHill continues to innovate and expand its services, it's poised to be a game-changer in the fintech industry. Stay tuned for more exciting developments from this groundbreaking startup.

You may also like: Web Developer Salaries in California

BlueHill's Roadmap

What Lies Ahead for BlueHill Payments?

As a startup founded in 2022, BlueHill Payments has embarked on an exciting journey to revolutionize the payment processing landscape. Here's a glimpse of what the future holds for this dynamic fintech company:

Expanding Merchant Network:

BlueHill plans to expand its network of merchants, offering more businesses the opportunity to streamline their payment processes and reduce costs.

Enhanced Features:

The startup is constantly innovating, with plans to introduce new features and tools that further simplify payment processing for its users.

Global Reach:

BlueHill Payments aspires to extend its reach beyond San Francisco and cater to businesses worldwide, helping them navigate the complexities of payment processing.

In Conclusion

BlueHill Payments, with its visionary founders and groundbreaking intelligent routing platform, is set to redefine the way businesses handle payments. By reducing fees, offering flexibility, and simplifying complex payment processes, this startup is making a significant impact in the fintech world. As it continues to evolve and expand its services, BlueHill Payments is undoubtedly a company to watch in the coming years. Stay tuned for more innovations that promise to transform the landscape of payment processing for businesses of all sizes.