Revolutionizing Construction Finance: How inBuild is Transforming the Industry

Construction finance is a complex realm where financial documents flow like a river, inundating builders and contractors with invoices, approvals, and budgets. It's an industry that has long been burdened by outdated processes and software solutions that simply don't keep up with the demands of modern construction projects. But what if there was a way to streamline this cumbersome workflow? Enter inBuild, a startup founded in 2021 by Ty Sharp and Ian Sharp, with a mission to revolutionize construction finance through workflow automation. In this article, we'll delve into the story behind inBuild, the challenges it aims to overcome, and the innovative solutions it offers to transform the construction finance landscape.

You may also like: Hire WooCommerce Developer

Founders' Vision

How did the founders of inBuild meet and what inspired them to become entrepreneurs?

In the world of startups, partnerships often form from a shared vision and complementary skills. Ty Sharp and Ian Sharp, the co-founders of inBuild, came together with a common goal of solving a significant problem they identified in the construction finance industry. Ty had served as the CFO at Sweeney Development, a prominent Aspen-based General Contractor responsible for building $350M in construction volume. It was during his tenure there that he realized the complexity and inefficiency of financial processes within the industry.

Ty's frustration with the available software solutions led him to approach his brother, Ian Sharp. At the time, Ian was contributing to the acquisition of Finvera, a San Francisco-based startup. Ty presented the idea of starting their own company to develop a platform that could address the financial challenges he had personally experienced. This meeting of minds and expertise laid the foundation for inBuild.

What inspired Ty and Ian to tackle the challenges of construction finance?

The inspiration behind inBuild's inception was rooted in Ty's firsthand experience as a financial controller in the construction industry. He recognized that construction finances had uniquely complex life cycles and were plagued by antiquated and disconnected solutions. Ty's frustration with the existing software options was the spark that ignited the idea of building a platform to revolutionize construction finance.

The Construction Finance Conundrum

What challenges does the construction finance industry face today?

Construction companies, regardless of their scale, grapple with several critical challenges in the realm of financial management:

High Document Volumes: The construction industry generates an enormous number of financial documents, including invoices, budgets, and contracts. Managing this high document volume is a time-consuming and error-prone task.

Lack of Industry Standardization: Unlike some industries that have established standards and protocols, construction finance lacks standardization, making it difficult to streamline processes and data exchange.

Complicated Approval Workflows: Approvals are a crucial part of construction finance. However, navigating the intricate web of approvals for each document can be a logistical nightmare.

Outdated Legacy Software: Many construction companies still rely on outdated software solutions that are clunky and inefficient, hindering productivity and accuracy.

You may also be interested in: Delving into the Cadence Concept in Business

The inBuild Solution

How does inBuild address these challenges?

In the face of these challenges, inBuild offers a comprehensive solution with its innovative platform. Here are the key components of their solution:

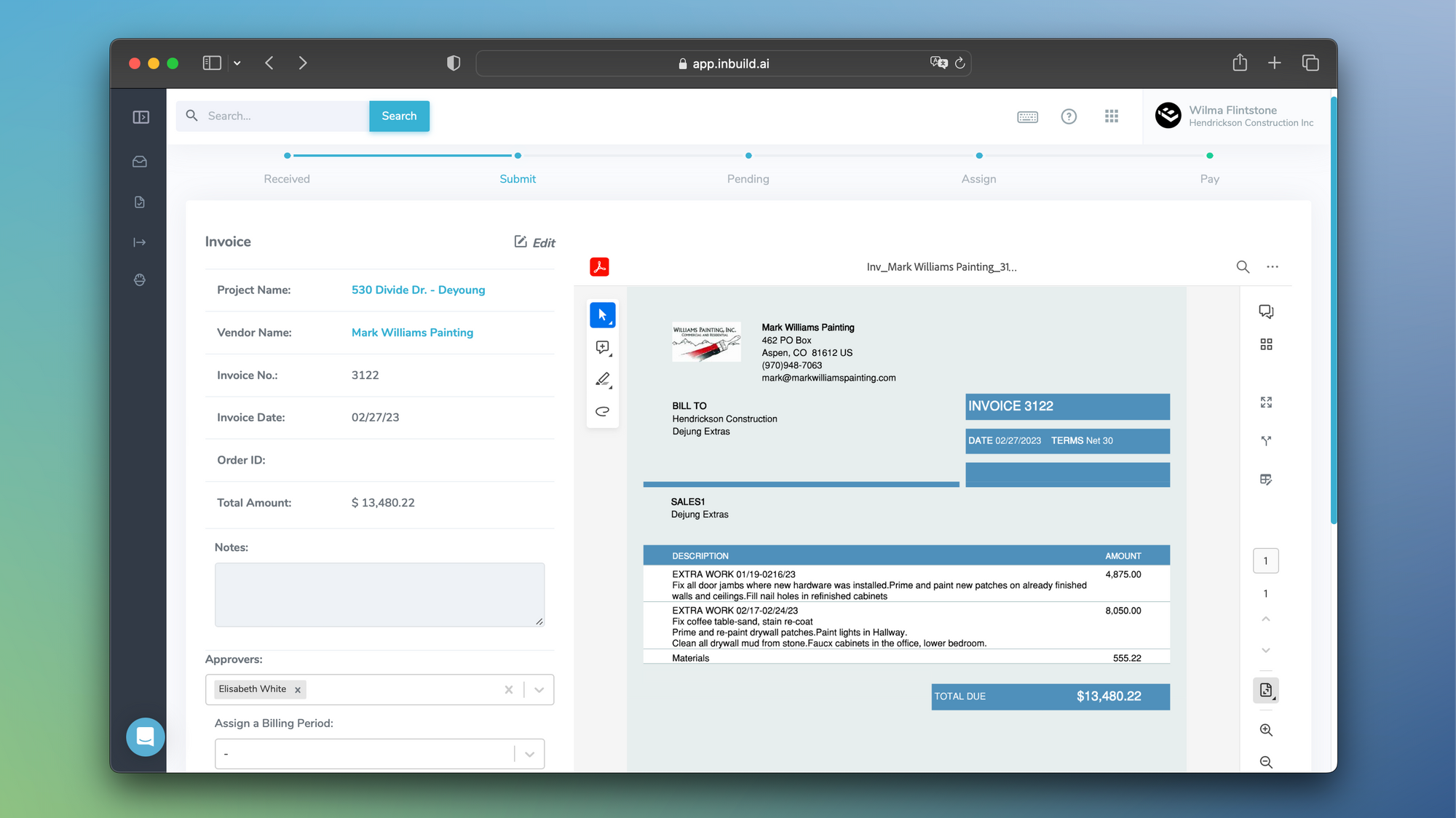

Ingesting Incoming Emails: inBuild's platform is designed to plug into email accounts and automatically extract incoming financial documents. This eliminates the need for manual data entry and ensures that no document is overlooked.

Customizing Account Details: The platform allows users to customize account details, tailoring the software to their specific needs. This flexibility ensures that inBuild works for the user, not against them.

Learning from Interaction: inBuild's intelligent system learns from user interactions. It becomes more efficient over time, adapting to the unique requirements and workflows of each construction company.

Automating Document Lifecycles: One of the standout features of inBuild is its ability to automate the entire document lifecycle. From invoice verification to budget reconciliation, inBuild streamlines the process, saving time and reducing errors.

Company Launch and Achievements

How did inBuild launch, and what milestones has it achieved?

inBuild officially launched in 2021 with the aim of transforming the construction finance landscape. Their mission is simple yet powerful: "Spend time building, not processing documents." Since its inception, inBuild has made significant strides in realizing this mission.

In practical terms, inBuild boosts revenue for home builders by automating the labor-intensive process of managing invoices. For instance, when a subcontractor sends an invoice for work they completed, inBuild steps in to check the cost against the project budget, handle necessary approvals, pay the bill, and update accounting systems like Quickbooks. This automation not only reduces the administrative burden but also minimizes the risk of errors and budget discrepancies.

What has been inBuild's impact on the construction finance industry?

Over the past 12 months, inBuild has processed a staggering $450 million of invoice volume. This level of activity speaks volumes about the industry's appetite for a solution that simplifies financial management. With over $8 million flowing through the platform daily, inBuild has demonstrated its ability to make a substantial impact on the construction finance ecosystem.

You may also like: Your Guide to Web Developer Salaries

Testimonials from Satisfied Customers

What are customers saying about inBuild?

The true measure of any startup's success lies in the satisfaction of its customers. inBuild has garnered praise from its clients, who have recognized the tangible benefits of its platform. Here's what one satisfied customer had to say:

“You often hear 'under promise and over deliver.' I don't believe that is the business model of inBuild, but they continually over-deliver.“ - Joey Zikor, CFO at Finbro Construction

Joey Zikor's testimonial is a testament to inBuild's commitment to providing exceptional value to its clients. By exceeding expectations, inBuild has cemented its reputation as a game-changer in the construction finance industry.

The Future of inBuild

What are inBuild's aspirations for the future?

In the startup world, success is not only about the journey but also about the destination. inBuild aspires to join the ranks of renowned Y Combinator alumni like Stripe, PlanGrid, and Balance. The founders have a clear vision of making inBuild a brand that is synonymous with innovation and excellence in the construction finance sector.

In pursuit of this vision, inBuild continues to leverage Y Combinator resources and programs to stay connected with the startup community. The inspiration drawn from the success stories of fellow YC alumni serves as a driving force for inBuild to reach greater heights.

Conclusion

The story of inBuild is one of innovation, determination, and a deep understanding of industry pain points. Ty and Ian Sharp, armed with their respective expertise and a shared vision, have embarked on a mission to streamline construction finance. With a platform that automates workflows, simplifies document management, and boosts efficiency, inBuild is not only transforming the industry but also empowering builders to focus on what they do best: building. As inBuild continues to grow and make waves in the construction finance sector, it is poised to become a prominent player in the world of startups, proving that innovation knows no bounds, even in the most traditional of industries.